Question: 4. (5 points) Assume that the expected return on the market portfolio is 15% with standard deviation of 20%. The risk-free rate is r =

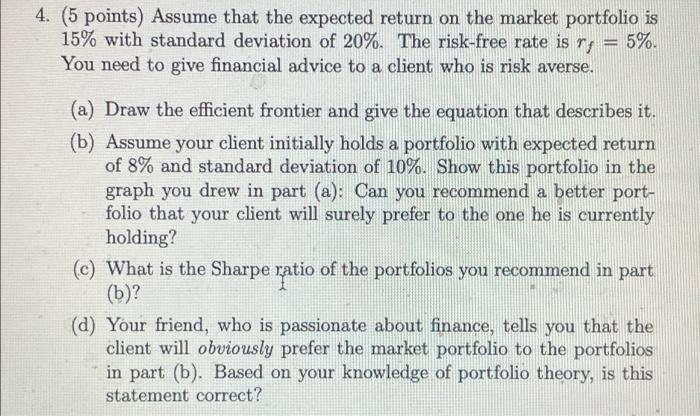

4. (5 points) Assume that the expected return on the market portfolio is 15% with standard deviation of 20%. The risk-free rate is r = 5%. You need to give financial advice to a client who is risk averse. (a) Draw the efficient frontier and give the equation that describes it. (b) Assume your client initially holds a portfolio with expected return of 8% and standard deviation of 10%. Show this portfolio in the graph you drew in part (a): Can you recommend a better port- folio that your client will surely prefer to the one he is currently holding? (c) What is the Sharpe ratio of the portfolios you recommend in part (b)? (d) Your friend, who is passionate about finance, tells you that the client will obviously prefer the market portfolio to the portfolios in part (b). Based on your knowledge of portfolio theory, is this statement correct? 4. (5 points) Assume that the expected return on the market portfolio is 15% with standard deviation of 20%. The risk-free rate is r = 5%. You need to give financial advice to a client who is risk averse. (a) Draw the efficient frontier and give the equation that describes it. (b) Assume your client initially holds a portfolio with expected return of 8% and standard deviation of 10%. Show this portfolio in the graph you drew in part (a): Can you recommend a better port- folio that your client will surely prefer to the one he is currently holding? (c) What is the Sharpe ratio of the portfolios you recommend in part (b)? (d) Your friend, who is passionate about finance, tells you that the client will obviously prefer the market portfolio to the portfolios in part (b). Based on your knowledge of portfolio theory, is this statement correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts