Question: please explain step by step. thank you 4. (5 points) Assume that the expected return on the market portfolio is 15% with standard deviation of

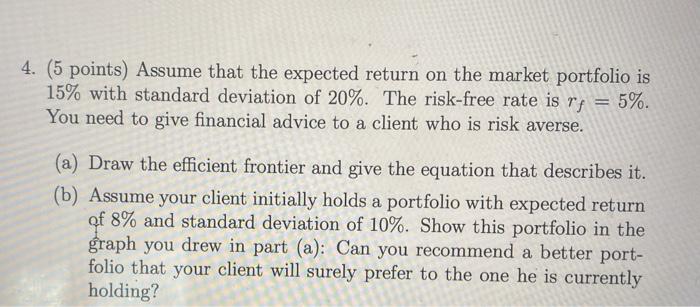

4. (5 points) Assume that the expected return on the market portfolio is 15% with standard deviation of 20%. The risk-free rate is r You need to give financial advice to a client who is risk averse. = 5%. (a) Draw the efficient frontier and give the equation that describes it. (b) Assume your client initially holds a portfolio with expected return of 8% and standard deviation of 10%. Show this portfolio in the graph you drew in part (a): Can you recommend a better port- folio that your client will surely prefer to the one he is currently holding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts