Question: 4. (5 points) Cal purchased six call option contracts through his broker. The option price is $2. The strike price is $46 and the current

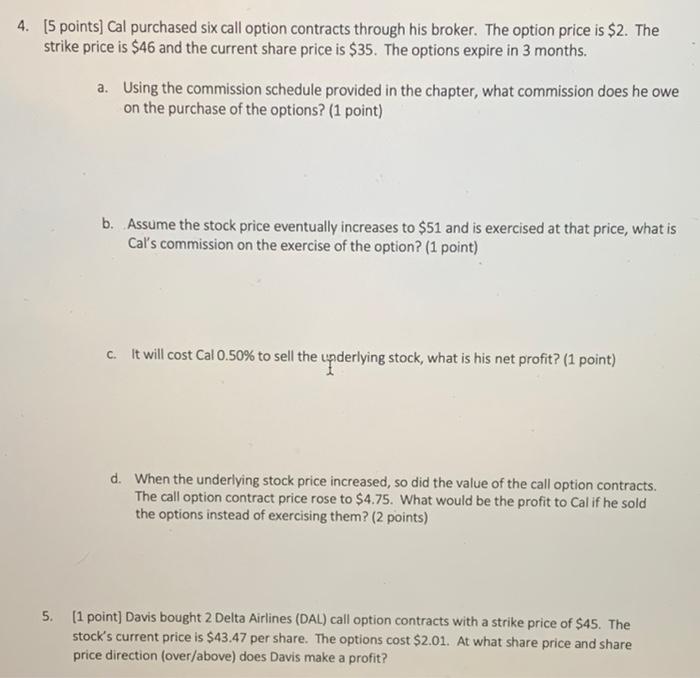

4. (5 points) Cal purchased six call option contracts through his broker. The option price is $2. The strike price is $46 and the current share price is $35. The options expire in 3 months. a. Using the commission schedule provided in the chapter, what commission does he owe on the purchase of the options? (1 point) b. Assume the stock price eventually increases to $51 and is exercised at that price, what is Cal's commission on the exercise of the option? (1 point) c. It will cost Cal 0.50% to sell the underlying stock, what is his net profit? (1 point) d. When the underlying stock price increased, so did the value of the call option contracts. The call option contract price rose to $4.75. What would be the profit to Cal if he sold the options instead of exercising them? (2 points) 5. [1 point] Davis bought 2 Delta Airlines (DAL) call option contracts with a strike price of $45. The stock's current price is $43.47 per share. The options cost $2.01. At what share price and share price direction (over/above) does Davis make a profit? 4. (5 points) Cal purchased six call option contracts through his broker. The option price is $2. The strike price is $46 and the current share price is $35. The options expire in 3 months. a. Using the commission schedule provided in the chapter, what commission does he owe on the purchase of the options? (1 point) b. Assume the stock price eventually increases to $51 and is exercised at that price, what is Cal's commission on the exercise of the option? (1 point) c. It will cost Cal 0.50% to sell the underlying stock, what is his net profit? (1 point) d. When the underlying stock price increased, so did the value of the call option contracts. The call option contract price rose to $4.75. What would be the profit to Cal if he sold the options instead of exercising them? (2 points) 5. [1 point] Davis bought 2 Delta Airlines (DAL) call option contracts with a strike price of $45. The stock's current price is $43.47 per share. The options cost $2.01. At what share price and share price direction (over/above) does Davis make a profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts