Question: 4. [6 points) Cal purchased seven call option contracts through his broker. The option price is $2.03. The strike price is $20, and the current

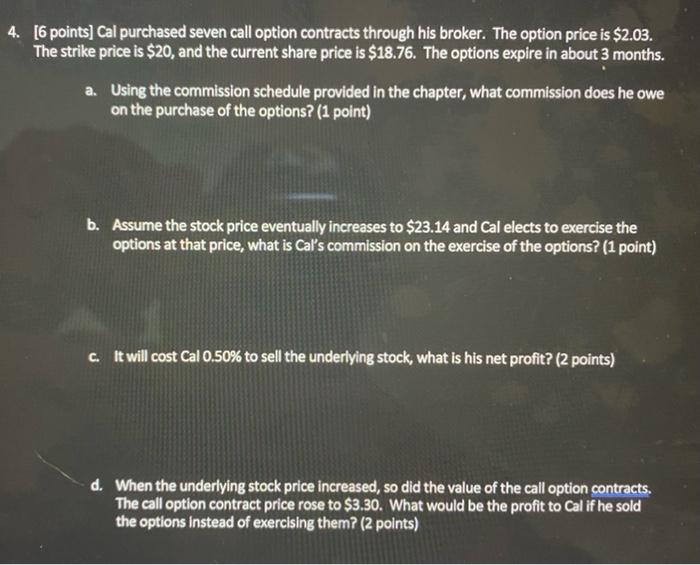

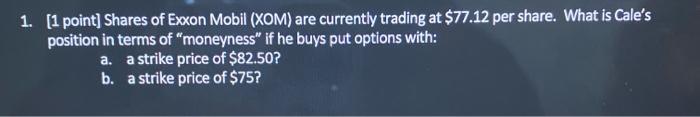

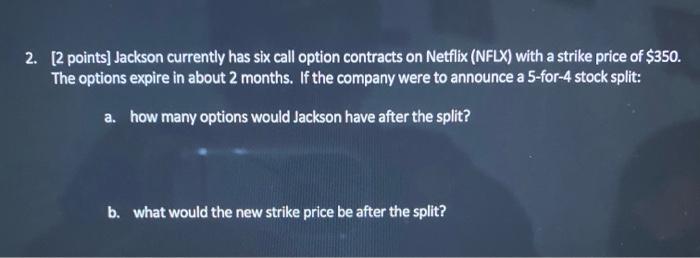

4. [6 points) Cal purchased seven call option contracts through his broker. The option price is $2.03. The strike price is $20, and the current share price is $18.76. The options expire in about 3 months. a. Using the commission schedule provided in the chapter, what commission does he owe on the purchase of the options? (1 point) b. Assume the stock price eventually increases to $23.14 and Cal elects to exercise the options at that price, what is Cal's commission on the exercise of the options? (1 point) c. It will cost Cal 0.50% to sell the underlying stock, what is his net profit? (2 points) d. When the underlying stock price increased, so did the value of the call option contracts. The call option contract price rose to $3.30. What would be the profit to Cal if he sold the options Instead of exercising them? (2 points) 1. [1 point] Shares of Exxon Mobil (XOM) are currently trading at $77.12 per share. What is Cale's position in terms of "moneyness" if he buys put options with: a. a strike price of $82.50? b. a strike price of $75? 2. [2 points] Jackson currently has six call option contracts on Netflix (NFLX) with a strike price of $350. The options expire in about 2 months. If the company were to announce a 5-for-4 stock split: a. how many options would Jackson have after the split? b. what would the new strike price be after the split? 3. [1 point) Davis bought two Delta Airlines (DAL) call option contracts with a strike price of $40. The stock's current price is $35.89 per share. The options cost $1.22. At what share price and share price direction (over/above) does Davis make a profit? 4. [6 points) Cal purchased seven call option contracts through his broker. The option price is $2.03. The strike price is $20, and the current share price is $18.76. The options expire in about 3 months. a. Using the commission schedule provided in the chapter, what commission does he owe on the purchase of the options? (1 point) b. Assume the stock price eventually increases to $23.14 and Cal elects to exercise the options at that price, what is Cal's commission on the exercise of the options? (1 point) c. It will cost Cal 0.50% to sell the underlying stock, what is his net profit? (2 points) d. When the underlying stock price increased, so did the value of the call option contracts. The call option contract price rose to $3.30. What would be the profit to Cal if he sold the options Instead of exercising them? (2 points) 1. [1 point] Shares of Exxon Mobil (XOM) are currently trading at $77.12 per share. What is Cale's position in terms of "moneyness" if he buys put options with: a. a strike price of $82.50? b. a strike price of $75? 2. [2 points] Jackson currently has six call option contracts on Netflix (NFLX) with a strike price of $350. The options expire in about 2 months. If the company were to announce a 5-for-4 stock split: a. how many options would Jackson have after the split? b. what would the new strike price be after the split? 3. [1 point) Davis bought two Delta Airlines (DAL) call option contracts with a strike price of $40. The stock's current price is $35.89 per share. The options cost $1.22. At what share price and share price direction (over/above) does Davis make a profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts