Question: 4. (5 points) Please indicate True or False. 1. General Partnership (GP) can have general and limited partners. 2. Partnerships, not partners, make the accounting

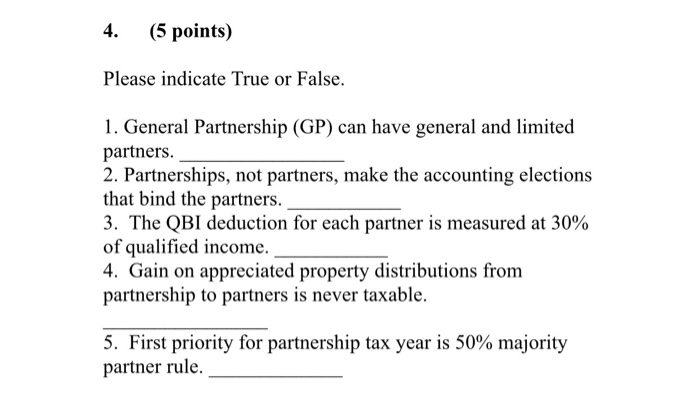

4. (5 points) Please indicate True or False. 1. General Partnership (GP) can have general and limited partners. 2. Partnerships, not partners, make the accounting elections that bind the partners. 3. The QBI deduction for each partner is measured at 30% of qualified income. 4. Gain on appreciated property distributions from partnership to partners is never taxable. 5. First priority for partnership tax year is 50% majority partner rule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts