Question: 4 ( 6 0 points ) . Applegate Financial is attempting to determine the current market value of a residential property assuming fee simple ownership.

points Applegate Financial is attempting to determine the current market value of a residential property assuming fee simple ownership. Table presents information on the subject property and several recent fee simple transactions.

Make the following assumptions: larger homes increase price by $ per square foot and house prices have increased by per month compounded over the past year. Baldwin is the least desirable and Montgomery is the most desirable school district. Being in Fisher increases price by $ relative to being in Baldwin, and being in Montgomery increases price by $ relative to being in Baldwin. Also, if the subject property is sold today, personal property such as furniture and appliances worth $ would be included and postdeal expenditures of $ would be required by the purchaser where postdeal expenditures refer to expenditures made immediately after purchase

The replacement cost for the house is $ per square foot and the property's land is valued at $ Physical depreciation is estimated to be percent of total replacement cost, functional obsolescence is estimated to be percent of total replacement cost, and external obsolescence is estimated to be $

The subject property is in a community with a homestead exemption of $

Table

tablePropertyPrice,tableTransactiondateSize,Condition of sale,tableFinancingtermstablePostsaleexpenditurestablePersonalpropertyincludedtableSchooldistrictSubjectFisher,A$Today,Arm's length,At market,$$FisherB$Today,Not Arm's length,At market,None,$FisherC$ months ago,Arm's length,At market,$$FisherD$Today,Arm's length,At market,$$BaldwinE$Today,Arm's length,Not at market,$None,FisherF$Today,Arm's length,At market,$$Montgomery

a What is Applegate Financial's indicated opinion of value for the subject property based on the cost approach? Round your answer to the nearest dollar and write it in the hox.

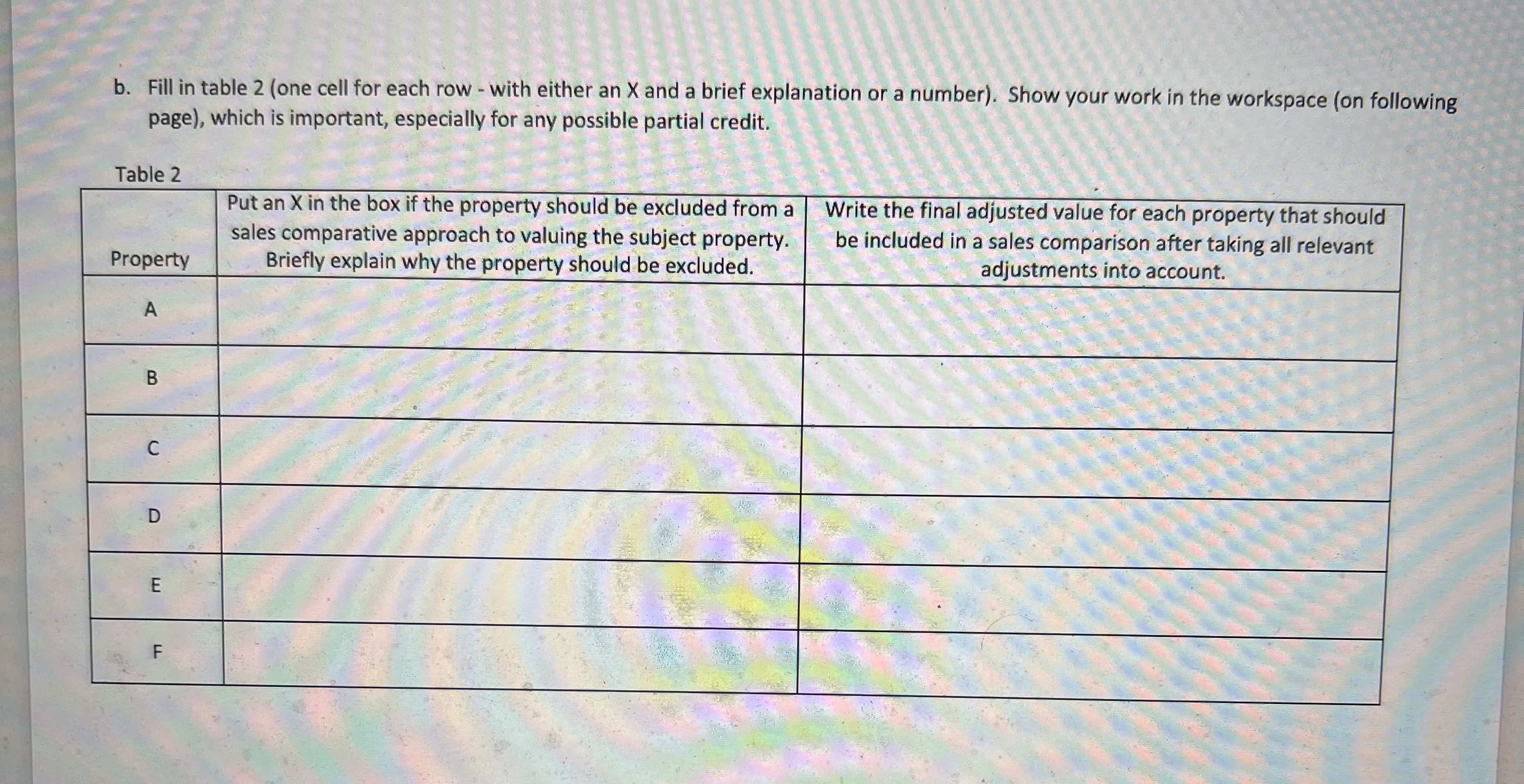

b Fill in table one cell for each row with either an and a brief explanation or a number Show your work in the workspace on following page which is important, especially for any possible partial credit.

Table

tablePropertytablePut an X in the box if the property should be excluded from asales comparative approach to valuing the subject property.Briefly explain why the property should be excluded.tableWrite the final adjusted value for each property that shouldbe included in a sales comparison after taking all relevantadjustments into account.ABCDEF

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock