Question: 4. (7 points) A Flexible Spending Account (FSA) is a special account you put money into that you use to pay for out-ofpocket health care

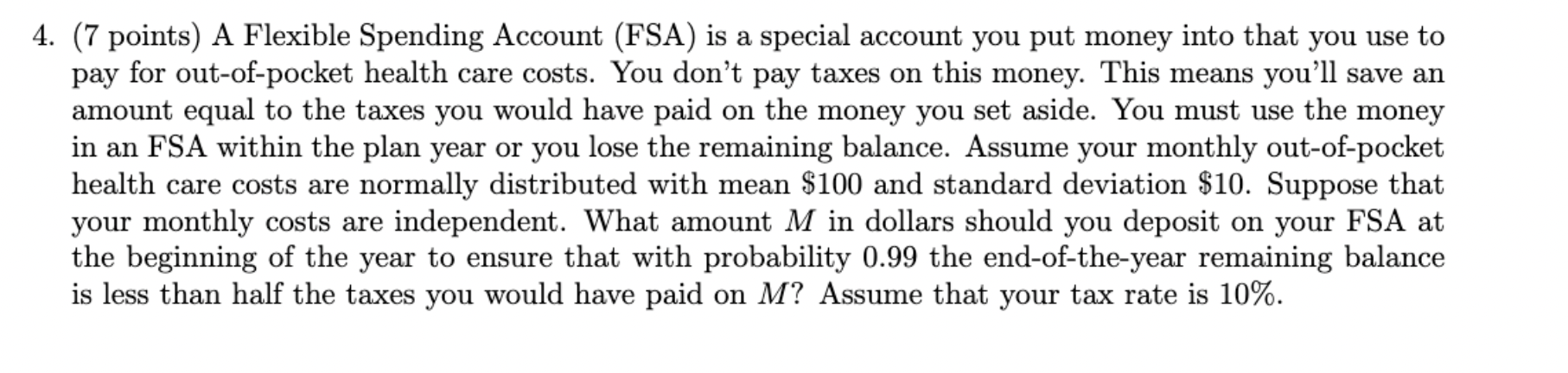

4. (7 points) A Flexible Spending Account (FSA) is a special account you put money into that you use to pay for out-ofpocket health care costs. You don't pay taxes on this money. This means you'll save an amount equal to the taxes you would have paid on the money you set aside. You must use the money in an F SA Within the plan year or you lose the remaining balance. Assume your monthly out-ofpocket health care costs are normally distributed with mean $100 and standard deviation $10. Suppose that your monthly costs are independent. What amount M in dollars should you deposit on your F SA at the beginning of the year to ensure that with probability 0.99 the end-ofthe-year remaining balance is less than half the taxes you would have paid on M ? Assume that your tax rate is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts