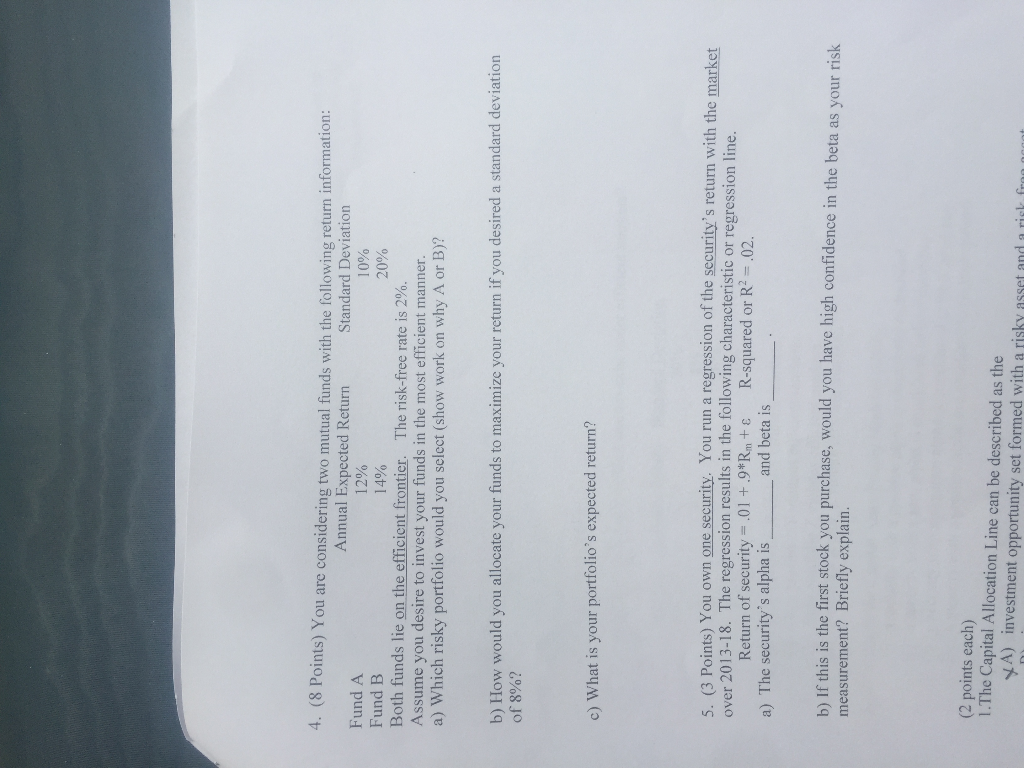

Question: 4. (8 Points) You are considering two mutual funds with the following return information: Annual Expected Return Standard Deviation Fund A 12% 10% Fund B

4. (8 Points) You are considering two mutual funds with the following return information: Annual Expected Return Standard Deviation Fund A 12% 10% Fund B 14% 20% Both funds lie on the efficient frontier. The risk-free rate is 2 %. Assume you desire to invest your funds in the most efficient manner. a) Which risky portfolio would you select (show work on why A or B)? b) How would you allocate your funds to maximize your return if you desired a standard deviation of 8%? c) What is your portfolio's expected return? 5. (3 Points) You own one security. You run a regression of the security's return with the market over 2013-18. The regression results in the following characteristic or regression line. .01+.9*Rm + & and beta is Return of security a) The security's alpha is R-squared or R2 02. b) If this is the first stock you purchase, would you have high confidence in the beta as your risk measurement? Briefly explain. (2 points each) 1.The Capital Allocation Line can be described as the YA) investment opportunity set formed with a risky asset and a rish 4. (8 Points) You are considering two mutual funds with the following return information: Annual Expected Return Standard Deviation Fund A 12% 10% Fund B 14% 20% Both funds lie on the efficient frontier. The risk-free rate is 2 %. Assume you desire to invest your funds in the most efficient manner. a) Which risky portfolio would you select (show work on why A or B)? b) How would you allocate your funds to maximize your return if you desired a standard deviation of 8%? c) What is your portfolio's expected return? 5. (3 Points) You own one security. You run a regression of the security's return with the market over 2013-18. The regression results in the following characteristic or regression line. .01+.9*Rm + & and beta is Return of security a) The security's alpha is R-squared or R2 02. b) If this is the first stock you purchase, would you have high confidence in the beta as your risk measurement? Briefly explain. (2 points each) 1.The Capital Allocation Line can be described as the YA) investment opportunity set formed with a risky asset and a rish

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts