Question: 4. A CLIENT HAS BEEN DENIED FOR A MORTGAGE DUE TO A LOW CREDIT SCORE. THE LENDER SUGGESTED THAT THE CLIENT OBTAIN HOMEOWNERSHIP COUNSELING. THE

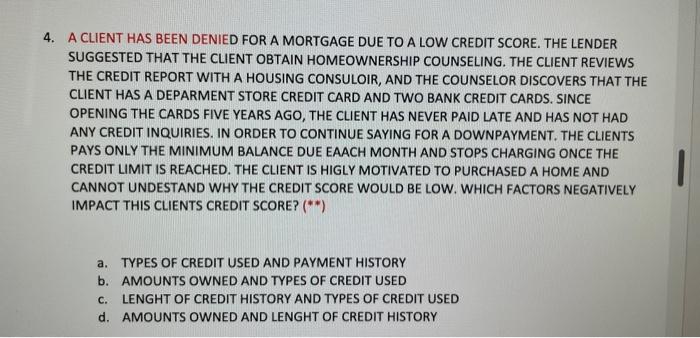

4. A CLIENT HAS BEEN DENIED FOR A MORTGAGE DUE TO A LOW CREDIT SCORE. THE LENDER SUGGESTED THAT THE CLIENT OBTAIN HOMEOWNERSHIP COUNSELING. THE CLIENT REVIEWS THE CREDIT REPORT WITH A HOUSING CONSULOIR, AND THE COUNSELOR DISCOVERS THAT THE CLIENT HAS A DEPARMENT STORE CREDIT CARD AND TWO BANK CREDIT CARDS. SINCE OPENING THE CARDS FIVE YEARS AGO, THE CLIENT HAS NEVER PAID LATE AND HAS NOT HAD ANY CREDIT INQUIRIES. IN ORDER TO CONTINUE SAYING FOR A DOWNPAYMENT. THE CLIENTS PAYS ONLY THE MINIMUM BALANCE DUE EAACH MONTH AND STOPS CHARGING ONCE THE CREDIT LIMIT IS REACHED. THE CLIENT IS HIGLY MOTIVATED TO PURCHASED A HOME AND CANNOT UNDESTAND WHY THE CREDIT SCORE WOULD BE LOW. WHICH FACTORS NEGATIVELY IMPACT THIS CLIENTS CREDIT SCORE? (**) a. TYPES OF CREDIT USED AND PAYMENT HISTORY b. AMOUNTS OWNED AND TYPES OF CREDIT USED c. LENGHT OF CREDIT HISTORY AND TYPES OF CREDIT USED d. AMOUNTS OWNED AND LENGHT OF CREDIT HISTORY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts