Question: I was not sure what table is needed for this question, so I included all of them. Not all of them will be used, so

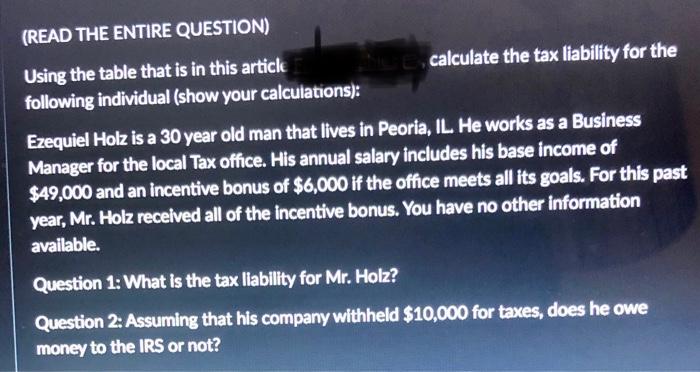

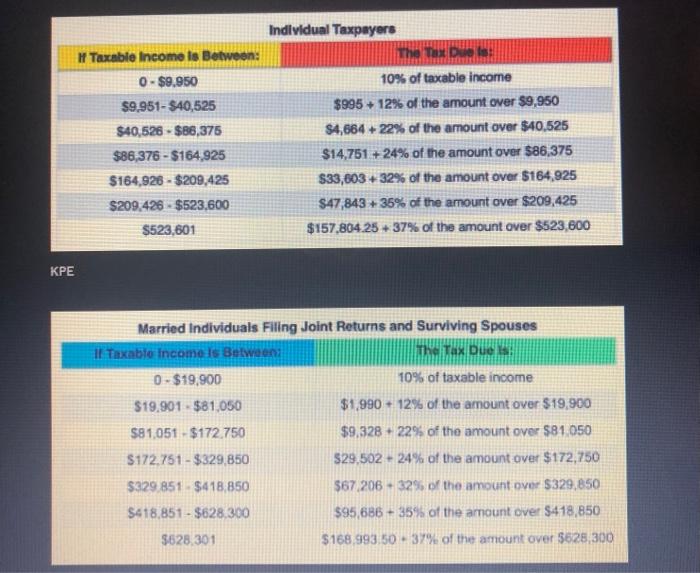

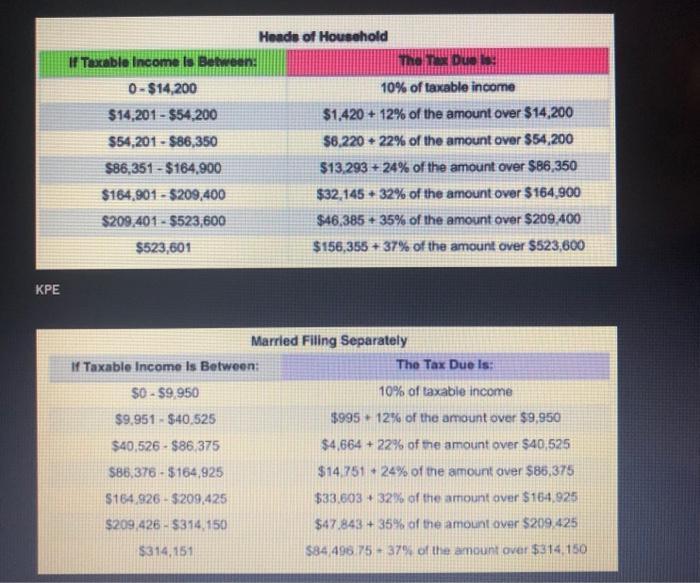

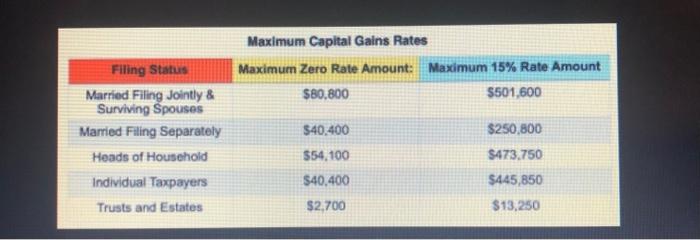

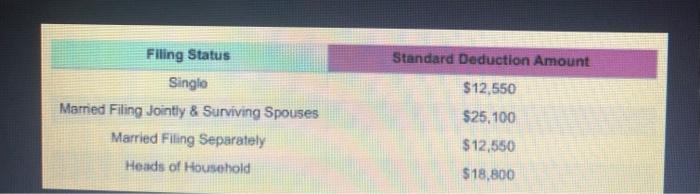

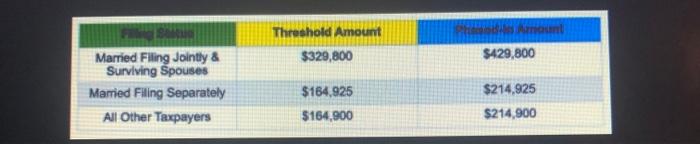

(READ THE ENTIRE QUESTION) Using the table that is in this article following individual (show your calculations): Ezequiel Holz is a 30 year old man that lives in Peoria, IL He works as a Business Manager for the local Tax office. His annual salary includes his base income of $49,000 and an incentive bonus of $6,000 if the office meets all its goals. For this past year, Mr. Holz received all of the incentive bonus. You have no other information available. Question 1: What is the tax liability for Mr. Holz? Question 2: Assuming that his company withheld $10,000 for taxes, does he owe money to the IRS or not? Indlvidual Taxpayers If Taxable income is Between: KPE Married Individuals Filing Joint Returns and Surviving Spouses If Taxabie income ls getwaen ihe Tax buexisin Heade of Household 0$14,200$14,201$54,200$54,201$86,350$86,351$164,900$164,901$209,400$209,401$523,600$523,60110%oftaxableincome$1,420+12%oftheamountover$14,200$6,220+22%oftheamountover$54,200$13,293+24%oftheamountover$86,350$32,145+32%oftheamountover$164,900$46,385+35%oftheamountover$209,400$156,355+37%oftheamountover$523,600 KPE Married Filing Separately If Taxable Income is Between: The Tax Due Is: $0$9,950$9,951$40,525$40,526$86,375$86,376$164,925$164.926$209,425$209,426$314,150$314,15110%oftaxabieincome$995+12%oftheamountover$9,950$4,664+22%oftheamountover$40,525$14.751+24%oftheamountover$86,375$33,603+32%oftheamountover$164,925$47,843+35%oftheamountover$209,425$84,4967537%oftheamountover$314,150 Maximum Capital Gains Rates \begin{tabular}{cc|c|} \hline & Maximum Zero Rate Amount: & Maximum 15% Rate Amount \\ \hline Married Filing Jointly \& & $80,800 & $501,600 \\ Surviving Spouses & $40,400 & \\ \hline Married Filing Separately & $54,100 & $250,800 \\ \hline Heads of Household & $40,400 & $473,750 \\ \hline Individual Taxpayers & $2,700 & $445,850 \\ Trusts and Estates & & $13,250 \\ \hline \end{tabular} \begin{tabular}{|c|cc|} \hline & Threshold Amount & Fing \\ \hline MarriedFilingJointly&SurvingSpouses & $329,800 & $429,800 \\ Maried Filing Separately & $164,925 & $214,925 \\ \hline All Other Taxpayers & $164,900 & $214,900 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts