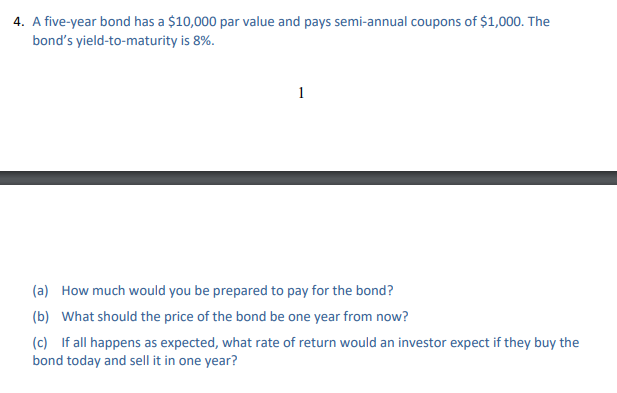

Question: 4. A five-year bond has a $10,000 par value and pays semi-annual coupons of $1,000. The bond's yield-to-maturity is 8%. 1 (a) How much would

4. A five-year bond has a $10,000 par value and pays semi-annual coupons of $1,000. The bond's yield-to-maturity is 8%. 1 (a) How much would you be prepared to pay for the bond? (b) What should the price of the bond be one year from now? (c) If all happens as expected, what rate of return would an investor expect if they buy the bond today and sell it in one year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts