Question: Question 22 A beta of 0.5 for a security indicates o the security has above average company-unique risk. o the security has above average market

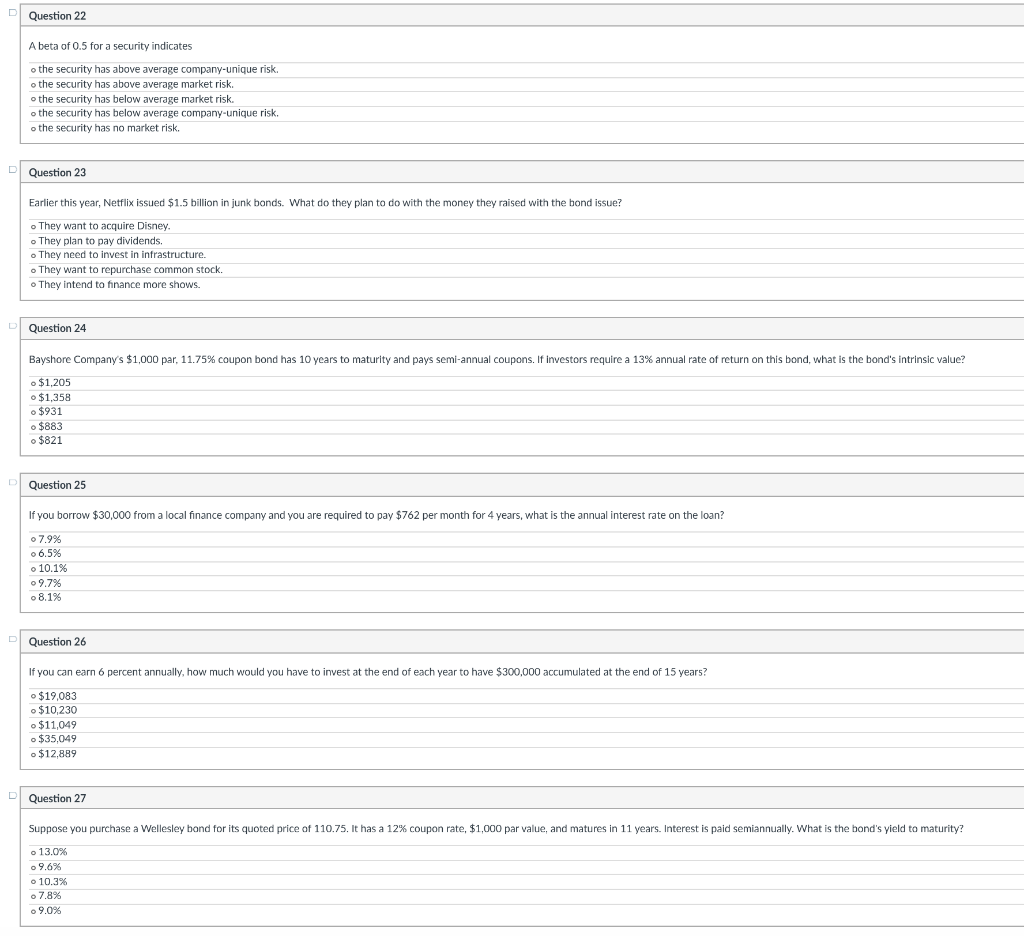

Question 22 A beta of 0.5 for a security indicates o the security has above average company-unique risk. o the security has above average market risk. o the security has below average market risk. o the security has below average company-unique risk. o the security has no market risk. D Question 23 Earlier this year, Netflix issued $1.5 billion in junk bonds. What do they plan to do with the money they raised with the bond issue? o They want to acquire Disney. They plan to pay dividends. o They need to invest in infrastructure. o They want to repurchase common stock. They intend to finance more shows Question 24 Bayshore Company's $1,000 par, 11.75% coupon bond has 10 years to maturity and pays semi-annual coupons. If investors require a 13% annual rate of return on this bond, what is the bond's intrinsic value? $1.205 $1,358 $931 $883 $821 D Question 25 If you borrow $30,000 from a local finance company and you are required to pay $762 per month for 4 years, what is the annual interest rate on the loan? 7.9% 6.5% 10.1% 09.7% o 8.1% Question 26 If you can earn 6 percent annually, how much would you have to invest at the end of each year to have $300,000 accumulated at the end of 15 years? $19,083 $10.230 $11,049 o $35,049 $12.889 D Question 27 Suppose you purchase a Wellesley band for its quoted price of 110.75. It has a 12% coupon rate, $1,000 par value, and matures in 11 years. Interest is paid semiannually. What is the bond's yield to maturity? o 13.0% o 9.6% o 10.3% o 7.8% . 9.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts