Question: 4 a) For the current year, Palladium Ltd. had net sales of $400,000 and paid $200,000 for the cost of goods sold. They had average

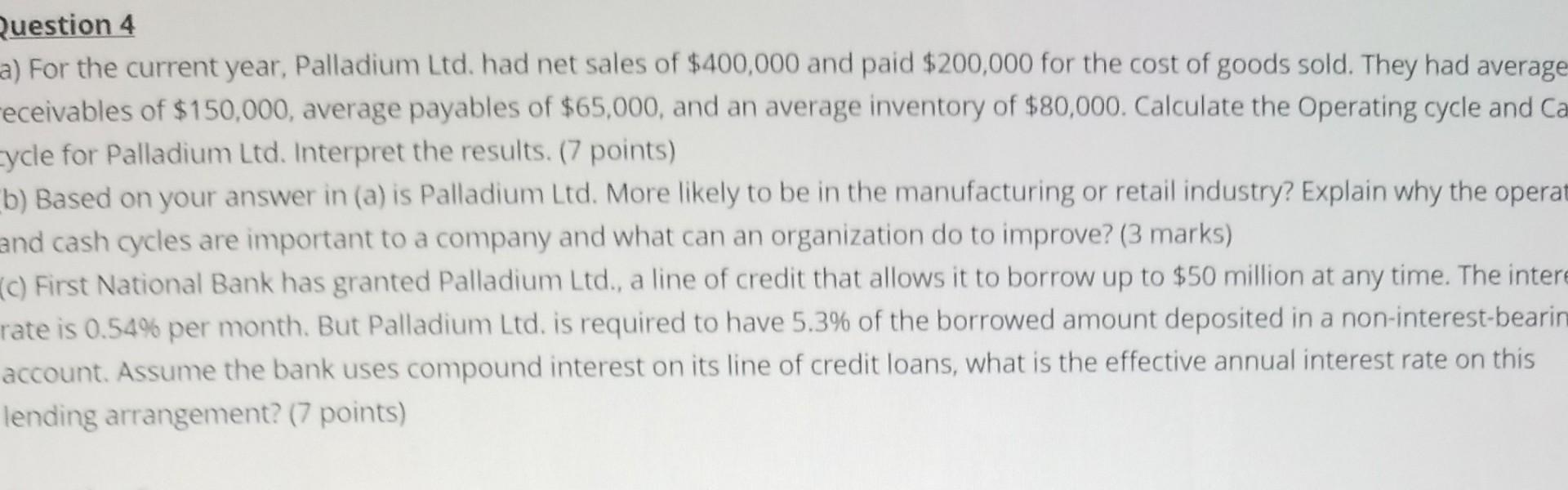

4 a) For the current year, Palladium Ltd. had net sales of $400,000 and paid $200,000 for the cost of goods sold. They had average receivables of $150,000, average payables of $65,000, and an average inventory of $80,000. Calculate the Operating cycle and Ca Cycle for Palladium Ltd. Interpret the results. (7 points) b) Based on your answer in (a) is Palladium Ltd. More likely to be in the manufacturing or retail industry? Explain why the operat and cash cycles are important to a company and what can an organization do to improve? (3 marks) (c) First National Bank has granted Palladium Ltd., a line of credit that allows it to borrow up to $50 million at any time. The intere rate is 0.54% per month. But Palladium Ltd. is required to have 5.3% of the borrowed amount deposited in a non-interest-bearin account. Assume the bank uses compound interest on its line of credit loans, what is the effective annual interest rate on this lending arrangement? (7 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts