Question: 4. A real estate developer is considering four possible projects: a small apartment complex, a small shopping center, a mini-warehouse, and a medium-size gas station.

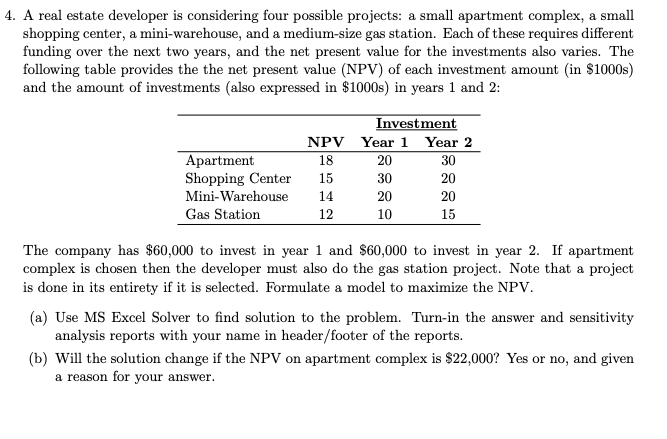

4. A real estate developer is considering four possible projects: a small apartment complex, a small shopping center, a mini-warehouse, and a medium-size gas station. Each of these requires different funding over the next two years, and the net present value for the investments also varies. The following table provides the the net present value (NPV) of each investment amount (in $1000s) and the amount of investments also expressed in $1000s) in years 1 and 2: Investment NPV Year 1 Year 2 20 30 Apartment Shopping Center Mini-Warehouse Gas Station 20 15 14 12 30 20 20 10 The company has $60,000 to invest in year 1 and $60,000 to invest in year 2. If apartment complex is chosen then the developer must also do the gas station project. Note that a project is done in its entirety if it is selected. Formulate a model to maximize the NPV. (a) Use MS Excel Solver to find solution to the problem. Turn-in the answer and sensitivity analysis reports with your name in header/footer of the reports. (b) Will the solution change if the NPV on apartment complex is $22,000? Yes or no, and given a reason for your answer. 4. A real estate developer is considering four possible projects: a small apartment complex, a small shopping center, a mini-warehouse, and a medium-size gas station. Each of these requires different funding over the next two years, and the net present value for the investments also varies. The following table provides the the net present value (NPV) of each investment amount (in $1000s) and the amount of investments also expressed in $1000s) in years 1 and 2: Investment NPV Year 1 Year 2 20 30 Apartment Shopping Center Mini-Warehouse Gas Station 20 15 14 12 30 20 20 10 The company has $60,000 to invest in year 1 and $60,000 to invest in year 2. If apartment complex is chosen then the developer must also do the gas station project. Note that a project is done in its entirety if it is selected. Formulate a model to maximize the NPV. (a) Use MS Excel Solver to find solution to the problem. Turn-in the answer and sensitivity analysis reports with your name in header/footer of the reports. (b) Will the solution change if the NPV on apartment complex is $22,000? Yes or no, and given a reason for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts