Question: 4 A- TRUE/FALSE-Please answer 9 (9 points- 1 point each) eriodic 1) In the United States, publicly traded companies can choose whether or not they

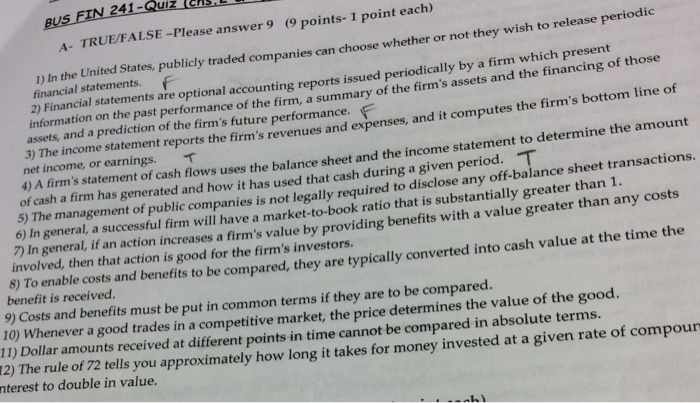

4 A- TRUE/FALSE-Please answer 9 (9 points- 1 point each) eriodic 1) In the United States, publicly traded companies can choose whether or not they wish to release p financial statements.F 2) Financial statements are optional accounting reports issued periodically by a firm which present information on the past performance of the firm, a summary of the firm's assets and the financing of those assets, and a prediction of the firm's future performance. 3) The income statement reports the firm's revenues and expenses, and it computes the firm's bottonm net income, or earnings. 4) A firm's statement of cash flows uses the balance sheet and the income statement to determine the amount of cash a firm has generated and how it has used that cash during a given period. 5) The management of public companies is not legally required to disclose any off-balance sheet transactions. 6) In general, a successful firm will have a market-to-book ratio that is substantially greater than 1. ) In general, if an action increases a firm's value by providing benefits with a value greater than any costs involved, then that action is good for the firm's investors. s ro enable costs and benefits to be compared, they are typically converted into cash value at the time the Costs and benefits must be put in common terms if they are to be compared. benefit is received. enever a good trades in a competitive market, the price determines the value of the good. 11) Dollar amounts received at different points in time cannot be compared in absolu te terms. 12) The rule of 72 tells you approximately how long it takes for money invested at a given rate of nterest to double in value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts