Question: please read the case and answer the critical thinking questions at the end PA) A Legal and Ethical Gray Area 41 Case 12 The Foreign

please read the case and answer the critical thinking questions at the end

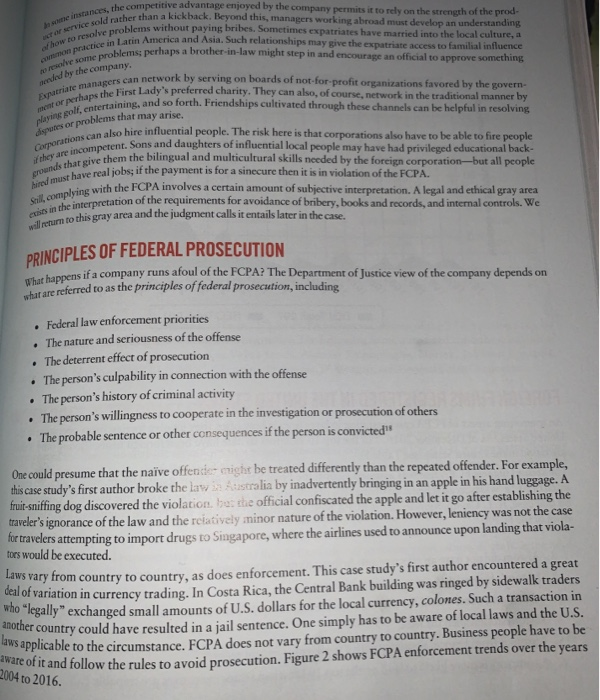

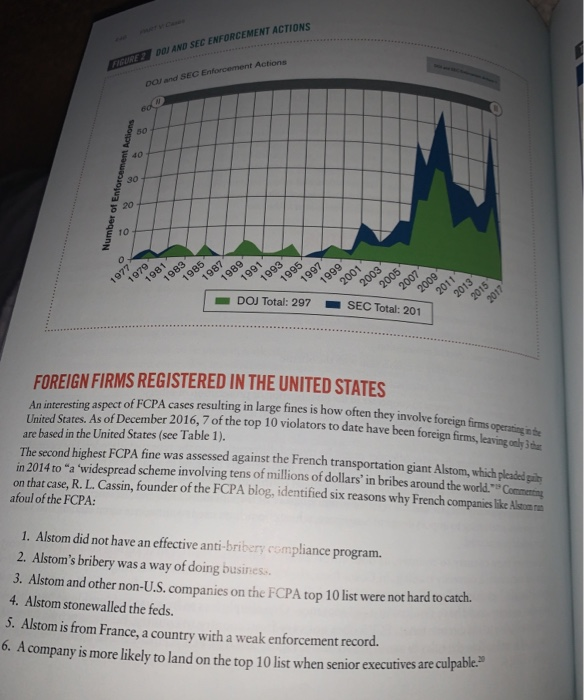

PA) A Legal and Ethical Gray Area 41 Case 12 The Foreign Corrupt Practices Act (FCPA): A Legal and Ethical Gray Area AUTHOR BIOGRAPHIES Asbjorn Osland, PhD, is a professor at San Jose State University. He teaches management and international business Nanette Clinch, JD, PhD (in English) is an instructor at San Jose State University. She teaches the legal environment of business. OVERVIEW The Foreign Corrupt Practices Act (FCPA) is a U.S. law that prohibits payments to foreign officials and requires publicly traded companies keep records in accord with generally accepted accounting principles (GAAP). A legal and ethical gray area exists regarding the FCPA exception for payments to facilitate routine government services. This case examines this exception, asking students to evaluate various examples in a hypothetical scenario. Some examples in the case are based on the first author's personal experiences. Guidance is also provided on best practices for FCPA compliance. BACKGROUND OF THE FOREIGN CORRUPT PRACTICES ACT (FCPA) Several institutions are active against corruption on the international scene. They include Transparency International,' a not-for-profit that rates countries for corruption; the Organisation for Economic Co-operation and Development (OECD), whose mission is to promote policies that will improve the economic and social well-being of people around the world, and the U.S. government and its Foreign Corrupt Practices Act (FCPA). The most aggressive of these is the U.S. government's use of the FCPA. To be able to make the ethical choice and take appropriate action in compliance with the law and regulations, one needs to understand the FCPA philosophy, Ethics reflects one's beliefs within the context of the organizational cul- ture, whereas compliance indicates what one must do to avoid legal difficulty. There should not be tension between the Iwo. If there is one must work to change the culture or amend one's beliefs to include doing the right thing, rather than what might be opportunistically profitable." However, if noncompliance is due to the law being unethical, then the law needs to be changed. When enacted in 1977, the FCPA made it illegal for Americans to pay foreign officials to aid in business. This case study's first author worked in Guatemala at the time and recalls conversing with Bank of America officials who leaders who did not have s for their countries and then hiquita Brands International, a lead- ed any bribery in Panama at the time. The en anyone else do, any. biled by the FCPA law and stated that the bank lost business to Japanese and German lenders who di ribery at that time. Foreign government officials would take out bank loans for their com get kickbacks from Bank of America's Japanese and German competitors. author also worked in Panama in the early 1990s and noted that Chiquita Brands Interna ing producer of bananas and of bananas and other fruit products, steadfastly avoided any bribery in Panama at the author had to sign a document several times annually certifying that he had not done, or seen anyone che shine illegal as part of a follow-up by the U.S. government because of prior difficulties with Chiquita In 1908. the FCPA was amended to prohibit corrupt payments made by foreign firms within the United to require that such firms maintain proper record keeping and adequate internal controls. Foreign firm listed in the United States often experience tension when established practices within their organizational sul are at odds with the laws of the United States. In particular, Chinese firms have had difficulty adaptin neculations: 2016 was a record year for FCPA-related fines: 27 firms were fined about $2.5 billion. 15 involved a Chinese business or subsidiary. PURPOSE OF THE FCPA The Foreign Corrupt Practices Act of 1977 seeks to prevent U.S. persons or agents of publicly traded compa nies from engaging in foreign corruption. The law prohibits bribery of foreign officials and mandates particular accounting procedures designed to reveal bribes. The criteria for identifying governmental control of an enti includes the degree of financial support given to the enterprise by the government, the "general perception of gov ernmental control, and other indicators. There are three exceptions to the FCPA. The first exception allows facilitation payments, which are payments made to expedite the performance of routine governmental action. The U.S. Security and Exchange Commission (SEC) explains in detail the actions that fall under this exception: Routine governmental action encompasses those actions which ordinarily and commonly are per formed by a foreign official in: (a) obtaining permits, licenses, or other official documents to qual ify a person to do business in a foreign country; (b) processing governmental papers, such as visas and work orders: (c) providing police protection, mail pick-up and delivery, or scheduling inspec tions associated with contract performance or inspections related to transit of goods across country (d) providing telephone service, power and water supply, loading and unloading cargo, or protecting per- ishable products or commodities from deterioration; or (e) actions of a similar nature. Routine governmen, tal action does not include, among other actions, any decision by a foreign official whether or on what terms to award new business to or to continue business with a company, or any action taken by a foreign official involved in the decision-making process to encourage a decision to award new business to, or continue bus ness with, a company. Facilitation payments are legal under FCPA; bribes are not. Proper documentation of such "facilitation pays is essential. It is best to inform one's compliance officer or controller before paying what one believes is ac tion payment to avoid the appearance of bribery. One should explain precisely what was paid, when, and why. The internal control system should codify and enforce appropriate procedures. The other two exceptions to the FCPA are referred to as affirmative defenses. That is, even if the allegation true (c.g., that a payment was made to a foreign company or official), the alleged action would escape under the FCPA. The two affirmative defenses are as follows: Gray Area 443 The payment, gilt, offer, or promise of anythin beforeign officials, political party's, party officials. omise of anything of value is lawful under the written laws and regulations of olitical party's, party officials, or candidate's country. wift, offer, or promise of anything of value is a reasonable and bona fide expenditure, such as bedeing expenses, directly related to the promotion, demonstration, or explanation of products the execution or performance of a contract with a foreign government or agency thereof." 2. The payment, gift, offre travel and lodging expe or services, or the execu word written in the explanation of the first affirmative defense means that one should customs, or on ludicrous or patently corrupt local practices, to justify what any reasonable SEC offi- The italicined wordt informal local custo cual would consider a bribe. Similarly, the second af abused this exception to All three of the FCPA cond affirmative defense is limited to reasonable and bona fide expenses. Companies have exception to pay for lavish vacations, thinking that they might fall within the law, but they do not." of the FCPA's exceptions can be vague; therefore, one should seek legal counsel or even consult the directly whenever in doubt. The U.S. Department of Justice (2012) FCPA Resource Guide recommends a company's compliance program clarify what is appropriate gift-giving. Clear guidelines and processes can an effective and efficient means for controlling gift-giving, deterring improper gifts, and protecting corporate CIRCUMVENTING THE FCPA Companies have been known to try various stratagems to work around the provisions of the FCPA (see Figure 1). For example, a company may seek to avoid scrutiny by awarding many small gifts instead of a few substantial payments. This case study's first author knew the representative of a U.S. firm working in Cameroon. The repre sentative made it a practice to give secretaries perfume and men token gifts of whiskey. He did not give these gifts in exchange for specific favors but, rather, believed that "les petites cadeaux" were appropriate in that milieu. By coincidence, in 1980, the author accompanied the same individual when leaving Cameroon. The representative knew the various guards and officials who were part of his whiskey-gift program, and they allowed him to leave with a large satchel that went uninspected. Upon arrival in Paris, the representative happened to open the satchel and the author observed that it was full of cash. Gifts to open doors may be allowed, but travelers are required to report large amounts of cash. It was unclear exactly what transpired because the author did not question his travel ing companion. another example, companies might attempt to avoid FCPA charges by distancing themselves from the individ lor entity they have engaged to cffectuate the bribe. Here, the FCPA searches for red flags such as "excessive sons" or "vaguely described services in an agency contract. To avoid such problems, companies should e due diligence to ensure trustworthy agents are engaged for services. Recommended procedures include reagent, questioning requests for discounts or commissions that notably exceed industry standards, and whether a task undertaken by a foreign official is within the scope of the official's typical duties. Although tations could jeopardize a fragile relationship grounded on a foreign state's bribery model of business, ask S a way to avoid liability and the excuse that a bribe was not clearly implicated." vetting the agent, questioning rey asking whether a task undertake such questions could jeopardize ing them is a way to avoid liability and BUUKKEEPING AND INTERNAL CONTROLS In addition to prohibiting brib Controls. Companies are bles (GAAP). It is easy to se to prohibiting bribery, the FCPA has two accounting requirements: books and records, and internal mpanies are reained to name in bookkeeping in accord with generally accepted accountineri . It is easy to see how maintaining such books provides a means of showing that the company is no gaging in bribery or other illegal payments. The requirement for internal controls is defu s is defined as being WORKING AROUND FCPA PROVISIONS sufficient to provide reasonable assurance FIGURE 1 ecuted in accordance with management tions are executed in accorda urances that are men's we rization; (b) transactions are recorded as paration of financial statements and to me ability for assets; (c) access to assets is limited to authorization; and (d) the recorded accountable compared with the existing assets at reasonable appropriate action is taken with respect to any difs eded as necesary to per and to maintain sed to managed countability for seasonable interval the respect to any difference oring of transaction Internal controls depend on routine monitoring of hout the firm. They flow from the top the audit com tee of the board, the controller reporting to the board executive officer (CEO) and other executives to the All personnel must be aware of the FCPA when opera international arena: U.S. citizens violating the law abroad prosecuted. The corporation must create a culture of de right thing where leaders show that ethical adherence to the tunt Managers need to understand that they will be fired or severely reprimanded al violators avoid controversy by asking internal board, the child cutives to the bottom Source: htthonour project.com/termba/26816/ ly reprimanded for violations. When word eets out that a company takes the FCPA seriously, potential violators auditors or even the external auditor for guidance. teis critical to establish an organizational climate of integrity, as exemplified in the following 1 External auditors should be used both annually in normal audits and when dealing with larse competitive bidding processes. 2. When corruption needs to be purged, leadership should bring in new accounting staff at all levels, include controller, assistant controller, travel reimbursement specialists, internal auditors, and so forth. 3. An audit committee should be created at the board level independent of the director. The controller should report directly to the audit committee, not to the director, 4. Audits should be publicly communicated. 5. Regular training of partner organizations should take place so that they understand the new culture and rules 6. Regular ethics training should occur with all employees participating. 7. The audit committee of the board should partner with the director in overseeing the culture change 8. The executives should participate in ethics forums at conferences, civic meetings, university.com and the like to show that they care about rooting out corruption. FCPA COMPLIANCE IN THE REAL WORLD ompanies competing in the global arena, is adhering to FCPA like working with your back? Not entirely. For one thing, the United State bribery," and the FCPA is not the only enforcement cy. For one thing, the United States is not the only country with laws aga CPA is not the only enforcement mechanism. But, apart from that mig mg field, effective negotiators and leaders learn to use the political reality and to their benefit without paying bribes. This requires extensive skill. ke working with one hand tied behind untry with laws against foreign from that mitigation of a level play utical reality and the social construction of business the competitive advantage enjoyed by the company permits it to rely on the strength of the prod- rather than a kickback. Beyond this, managers working abroad must develop an understanding problems without paying bribes. Sometimes expatriates have married into the local culture, a Latin America and Asia. Such relationships may give the expatriate access to familial influence hems perhaps a brother-in-law micht step in and encourage an official to approve something instances, the or service sold rathe how to resolve all mon practice in Lati orolve some probleme unded by the company. Expatriate managers a mentor perhaps the Fire playing golf, entertainine can network by serving on boards of not-for-profit organizations favored by the govern she First Lady's preferred charity. They can also, of course, network in the traditional manner by caining, and so forth. Friendships cultivated through these channels can be helpful in resolving sues or problems that may arise. Corporations can also hi at they are incompetent, Son grounds that give them the hired must have real Sell, complying with the exists in the interpretation of will return to this gray area also hire influential people. The risk here is that corporations also have to be able to fire people etent. Sons and daughters of influential local people may have had privileged educational back- ve them the bilingual and multicultural skills needed by the foreign corporation but all people ve real jobs; if the payment is for a sinecure then it is in violation of the FCPA. with the FCPA involves a certain amount of subjective interpretation. A legal and ethical gray area terpretation of the requirements for avoidance of bribery.books and records, and internal controls. We to this gray area and the judgment calls it entails later in the case. PRINCIPLES OF FEDERAL PROSECUTION appens if a company runs afoul of the FCPA? The Department of Justice view of the company depends on are referred to as the principles of federal prosecution, including . Federal law enforcement priorities The nature and seriousness of the offense The deterrent effect of prosecution The person's culpability in connection with the offense The person's history of criminal activity . The person's willingness to cooperate in the investigation or prosecution of others . The probable sentence or other consequences if the person is convicted" One could presume that the naive offentlecright be treated differently than the repeated offender. For example, this case study's first author broke the law s tralia by inadvertently bringing in an apple in his hand luggage. A fruit-sniffing dog discovered the violation, but the official confiscated the apple and let it go after establishing the traveler's ignorance of the law and the relatively minor nature of the violation. However, leniency was not the case for travelers attempting to import drugs to Singapore, where the airlines used to announce upon landing that viola- tors would be executed. ws vary from country to country, as does enforcement. This case study's first author encountered a great of variation in currency trading. In Costa Rica, the Central Bank building was ringed by sidewalk traders legally exchanged small amounts of U.S. dollars for the local currency, colones. Such a transaction in er country could have resulted in a jail sentence. One simply has to be aware of local laws and the U.S. applicable to the circumstance. FCPA does not vary from country to country. Business people have to be it and follow the rules to avoid prosecution. Figure 2 shows FCPA enforcement trends over the years aware of it and follow the rules to av 2004 to 2016 E DO AND SEC ENFORCEMENT ACTIONS DOS and SEC Enforcement Actions Number of Enforcement Action 2001 1999 1997 1999 2003 2000 200.000 DOJ Total: 297 SEC Total: 201 1979 1981 1983 1985 1987 1989 2013 2015 2017 FOREIGN FIRMS REGISTERED IN THE UNITED STATES w often they involve foreign firms operating inte lators to date have been foreign firms, leaving only 3 An interesting aspect of FCPA cases resulting in large fines is how often they involve for United States. As of December 2016, 7 of the top 10 violators to date have been for are based in the United States (see Table 1). The and highest FCPA fine was assessed against the French transportation giant Alstom which in 2014 to a widespread scheme involving tens of millions of dollars' in bribes around the world.Com on that case, R. L. Cassin, founder of the FCPA blog, identified six reasons why French companies like Alston afoul of the FCPA: 1. Alstom did not have an effective anti-bribery compliance program. 2. Alstom's bribery was a way of doing business. 3. Alstom and other non-U.S. companies on the FCPA top 10 list were not hard to catch. 4. Alstom stonewalled the feds. 5. Alstom is from France, a country with a weak enforcement record. 6. A company is more likely to land on the top 10 list when senior executives are culpab TABLE 1 TOP TEN FCPA VIOLATORS Rank Firm Name Country Siemens Year Germany Alstom 2008 France Amount $800 million $772 million $579 milion $519 million KBR/Halliburton USA 2014 2009 TEVA Pharmaceutical Israel Odebrecht/Braskem Brazil 2016 2016 $420 million Och-Ziff USA $412 million 2016 BAE UK $400 million 2010 Total SA France $398 million 2013 9 VimpelCom Netherlands $397.6 million 2016 Alcoa USA $384 million 2014 Data from Cassin, RL (December 29, 2016). TEVA ranks fourth on our new top ten ist FCPA Bog post. Retrieved from http://www Source: Data Wacom/blog/2016/12/29/reconsidered-odebrecht-and-braskem-are-on-our-los-loc-len-Lhtml In 2016, the SEC cited a record number of firms (27) for FCPA violations. Fifteen of the 27 corporate citations were for violations involving Chinese officials or entities. The following firms were fined for bribery in China: Sciclone, PTC, Qualcomm, Novartis, Las Vegas Sands, Akamai Technologies, Nortek, Johnson Controls, AstraZeneca, Nu Skin, HMT LLC, NHC, GlaxoSmithKline plc, JP Morgan, and General Cable Corporation. WHEN DOES PETTY GRAFT BECOME ILLEGAL? It is not always easy drawing the line between petty graft and FCPA violation. Following are six hypothetical sce- narios generally based on real-life situations of a nongovernmental organization (NGO) U.S.expatriate director working in Senegal. Review the following vignettes and decide whether an FCPA violation occurred based on the criteria presented earlier in this case. Scenario 1: Upon arrival in Senegal for an assignment with an NGO, the expatriate director's personal effects sat in crates on the wharf, exposed to the elements and theft. He readily complied with the customs official's request for an additional $100 for overtime. The freight forwarding company had warned him not to pay this surcharge because it was graft, and payment would habituate the customs official to future expectations of graft. Is the addi- tional $100 surcharge payment an FCPA violation? Scenario 2: The Senegalese government assigned a staff member named Amadou to oversee the expatriate direc- of s agency. Amadou asked the director for $75 to repair a vehicle that they could use while awaiting approval or duty-free importation of an organizational vehicle. The director advanced Amadou the money, and Amadou ked to the sky and declared, "God is great." The director thought it curious, but then reflected on the incident alled that Amadou had just told him he was having trouble coming up with the obligatory 100-kilo bag of u owed his first wife. Amadou lived with his younger second wife but still had some responsibility for the first. the director let it go as a miscellaneous vance an FCPA violation? hepext few months, the expatru who reputedly felt he knew a great deal about NGO development program The vehicle repair did not happen, but the director erilen at his job otherwise is the advance an FCPA S e t As the program in Senegal began to grow over the warmed that a board member who reputedly fel Dakar. The director was to meet the board member The director thought it prudent to invite the local regional watation. The director had advanced Sardou the cost of the sono speak to the director immediately before the meetin regret that he had somehow lost the $200 the dir thought that he was trying to double dip, but gave him the here to explain the NGO prog vernmental head, Saidou, to expl the trip (i.c., gas, hotel and meals. In with the board member. He ex am that he how lost the $200 the director had advanced to him for the travel expenses. The che 5200 nonetheless. Sandou then presented violation? director for governmental activities, Issa, sometimes stopped by to set the rural office and home. Ons to pay for tires for his vehicle and some office sts. Are these payments an FCPA violation? office supplies to the board member. Is the $200 payment an FCPA violation Scenario 4: The local regional director for and Amadou. They too reciproca They too reciprocated and visited Issa in his very modest sions, Issa asked the director for assistance to pay for $200 at a time. The director complied with these requests. Are these paym - The NGO grew and its projects were successful. Then one day EIL controlled all hiring in the area, sum about the obligatory four hour wait; he simply brou finally admitted the director to his office just before Elhadji could either do an audit of the NGO Il birine in the area, summoned the director to his office. The directe Flhadi, the local work inspect is office. The director knew enough to paperback book and enjoyed the respite from work director that at this very Performing an immediatt mind even if made up. Elhadji would prefer soo kilometers. The didnt FCPA violate be director to his office just before lunchtime and informed the d or do an audit of the NGO's office or go to Dakar for a meeting. Performing an LNG was a threat by Elhadji, who would then find some violation even if Dale hurt be lacked the $100 needed for gasoline to get there, a round trip of ALL Elhadji $100 in gasoline coupons $100 in gasoline coupons so Elhadji could go to Dakar. Is the $100 gas payment an FCPA contracted with a local carpenter to build school desks. Since the project was Scenario 6: The director contracted with a local carnenter to warrant the purchase of a table saw, the director advanced the carpenter around $10 other materials. The carpenter failed to deliver on time, and it was rumored he was list life than usual. Amadou took note and summoned the carpenter's older male relatives to carpenter into compliance with the contract. This proved successful. The other approach was the police would have beaten the carpenter and jailed him. The director explained all of this to the inte when he visited. Is the initial $10,000 advancement to the carpenter an FCPA violation? around $10,000 to buy the sand d it was rumored he was living a higher standard Critical Thinking Questions 1. Explain whether each of the six payments the director made was either legal or an FCPA violation. If you the director, how would you have addressed ach of these six situations? 2. A foreign firm just listed on the U.S. stock exchange hired you to help with logistics. Outside the United standard business practice is to pay government officials a retainer to sign legal documents that they routinely process. The foreign firm's headquarters abroad can claim these "retainers as business Law firms abroad handle the payment of the "retainers that are billed to your firm as legal fees. To boss working in the United States ordered you to follow the established practice abroad and per What should you do? strict attorney focuses on what she perceives as corrupt business practices. You ben the difference between a facilitation payment and a bribe. The payment you are ab bribe if it were paid to an official, but you a were paid to an official, but you are paving it to a business associate from a priva that would clearly be a bribe had you paid it to an official. Should you py last audit of your firm's foreign subsidiaries resulted in a finding that someo bribes. U.S. officials have not charged you. What should you do? aces. You believe you understand at you are about to make would be om a private firm fora sentit of the payments and we PA) A Legal and Ethical Gray Area 41 Case 12 The Foreign Corrupt Practices Act (FCPA): A Legal and Ethical Gray Area AUTHOR BIOGRAPHIES Asbjorn Osland, PhD, is a professor at San Jose State University. He teaches management and international business Nanette Clinch, JD, PhD (in English) is an instructor at San Jose State University. She teaches the legal environment of business. OVERVIEW The Foreign Corrupt Practices Act (FCPA) is a U.S. law that prohibits payments to foreign officials and requires publicly traded companies keep records in accord with generally accepted accounting principles (GAAP). A legal and ethical gray area exists regarding the FCPA exception for payments to facilitate routine government services. This case examines this exception, asking students to evaluate various examples in a hypothetical scenario. Some examples in the case are based on the first author's personal experiences. Guidance is also provided on best practices for FCPA compliance. BACKGROUND OF THE FOREIGN CORRUPT PRACTICES ACT (FCPA) Several institutions are active against corruption on the international scene. They include Transparency International,' a not-for-profit that rates countries for corruption; the Organisation for Economic Co-operation and Development (OECD), whose mission is to promote policies that will improve the economic and social well-being of people around the world, and the U.S. government and its Foreign Corrupt Practices Act (FCPA). The most aggressive of these is the U.S. government's use of the FCPA. To be able to make the ethical choice and take appropriate action in compliance with the law and regulations, one needs to understand the FCPA philosophy, Ethics reflects one's beliefs within the context of the organizational cul- ture, whereas compliance indicates what one must do to avoid legal difficulty. There should not be tension between the Iwo. If there is one must work to change the culture or amend one's beliefs to include doing the right thing, rather than what might be opportunistically profitable." However, if noncompliance is due to the law being unethical, then the law needs to be changed. When enacted in 1977, the FCPA made it illegal for Americans to pay foreign officials to aid in business. This case study's first author worked in Guatemala at the time and recalls conversing with Bank of America officials who leaders who did not have s for their countries and then hiquita Brands International, a lead- ed any bribery in Panama at the time. The en anyone else do, any. biled by the FCPA law and stated that the bank lost business to Japanese and German lenders who di ribery at that time. Foreign government officials would take out bank loans for their com get kickbacks from Bank of America's Japanese and German competitors. author also worked in Panama in the early 1990s and noted that Chiquita Brands Interna ing producer of bananas and of bananas and other fruit products, steadfastly avoided any bribery in Panama at the author had to sign a document several times annually certifying that he had not done, or seen anyone che shine illegal as part of a follow-up by the U.S. government because of prior difficulties with Chiquita In 1908. the FCPA was amended to prohibit corrupt payments made by foreign firms within the United to require that such firms maintain proper record keeping and adequate internal controls. Foreign firm listed in the United States often experience tension when established practices within their organizational sul are at odds with the laws of the United States. In particular, Chinese firms have had difficulty adaptin neculations: 2016 was a record year for FCPA-related fines: 27 firms were fined about $2.5 billion. 15 involved a Chinese business or subsidiary. PURPOSE OF THE FCPA The Foreign Corrupt Practices Act of 1977 seeks to prevent U.S. persons or agents of publicly traded compa nies from engaging in foreign corruption. The law prohibits bribery of foreign officials and mandates particular accounting procedures designed to reveal bribes. The criteria for identifying governmental control of an enti includes the degree of financial support given to the enterprise by the government, the "general perception of gov ernmental control, and other indicators. There are three exceptions to the FCPA. The first exception allows facilitation payments, which are payments made to expedite the performance of routine governmental action. The U.S. Security and Exchange Commission (SEC) explains in detail the actions that fall under this exception: Routine governmental action encompasses those actions which ordinarily and commonly are per formed by a foreign official in: (a) obtaining permits, licenses, or other official documents to qual ify a person to do business in a foreign country; (b) processing governmental papers, such as visas and work orders: (c) providing police protection, mail pick-up and delivery, or scheduling inspec tions associated with contract performance or inspections related to transit of goods across country (d) providing telephone service, power and water supply, loading and unloading cargo, or protecting per- ishable products or commodities from deterioration; or (e) actions of a similar nature. Routine governmen, tal action does not include, among other actions, any decision by a foreign official whether or on what terms to award new business to or to continue business with a company, or any action taken by a foreign official involved in the decision-making process to encourage a decision to award new business to, or continue bus ness with, a company. Facilitation payments are legal under FCPA; bribes are not. Proper documentation of such "facilitation pays is essential. It is best to inform one's compliance officer or controller before paying what one believes is ac tion payment to avoid the appearance of bribery. One should explain precisely what was paid, when, and why. The internal control system should codify and enforce appropriate procedures. The other two exceptions to the FCPA are referred to as affirmative defenses. That is, even if the allegation true (c.g., that a payment was made to a foreign company or official), the alleged action would escape under the FCPA. The two affirmative defenses are as follows: Gray Area 443 The payment, gilt, offer, or promise of anythin beforeign officials, political party's, party officials. omise of anything of value is lawful under the written laws and regulations of olitical party's, party officials, or candidate's country. wift, offer, or promise of anything of value is a reasonable and bona fide expenditure, such as bedeing expenses, directly related to the promotion, demonstration, or explanation of products the execution or performance of a contract with a foreign government or agency thereof." 2. The payment, gift, offre travel and lodging expe or services, or the execu word written in the explanation of the first affirmative defense means that one should customs, or on ludicrous or patently corrupt local practices, to justify what any reasonable SEC offi- The italicined wordt informal local custo cual would consider a bribe. Similarly, the second af abused this exception to All three of the FCPA cond affirmative defense is limited to reasonable and bona fide expenses. Companies have exception to pay for lavish vacations, thinking that they might fall within the law, but they do not." of the FCPA's exceptions can be vague; therefore, one should seek legal counsel or even consult the directly whenever in doubt. The U.S. Department of Justice (2012) FCPA Resource Guide recommends a company's compliance program clarify what is appropriate gift-giving. Clear guidelines and processes can an effective and efficient means for controlling gift-giving, deterring improper gifts, and protecting corporate CIRCUMVENTING THE FCPA Companies have been known to try various stratagems to work around the provisions of the FCPA (see Figure 1). For example, a company may seek to avoid scrutiny by awarding many small gifts instead of a few substantial payments. This case study's first author knew the representative of a U.S. firm working in Cameroon. The repre sentative made it a practice to give secretaries perfume and men token gifts of whiskey. He did not give these gifts in exchange for specific favors but, rather, believed that "les petites cadeaux" were appropriate in that milieu. By coincidence, in 1980, the author accompanied the same individual when leaving Cameroon. The representative knew the various guards and officials who were part of his whiskey-gift program, and they allowed him to leave with a large satchel that went uninspected. Upon arrival in Paris, the representative happened to open the satchel and the author observed that it was full of cash. Gifts to open doors may be allowed, but travelers are required to report large amounts of cash. It was unclear exactly what transpired because the author did not question his travel ing companion. another example, companies might attempt to avoid FCPA charges by distancing themselves from the individ lor entity they have engaged to cffectuate the bribe. Here, the FCPA searches for red flags such as "excessive sons" or "vaguely described services in an agency contract. To avoid such problems, companies should e due diligence to ensure trustworthy agents are engaged for services. Recommended procedures include reagent, questioning requests for discounts or commissions that notably exceed industry standards, and whether a task undertaken by a foreign official is within the scope of the official's typical duties. Although tations could jeopardize a fragile relationship grounded on a foreign state's bribery model of business, ask S a way to avoid liability and the excuse that a bribe was not clearly implicated." vetting the agent, questioning rey asking whether a task undertake such questions could jeopardize ing them is a way to avoid liability and BUUKKEEPING AND INTERNAL CONTROLS In addition to prohibiting brib Controls. Companies are bles (GAAP). It is easy to se to prohibiting bribery, the FCPA has two accounting requirements: books and records, and internal mpanies are reained to name in bookkeeping in accord with generally accepted accountineri . It is easy to see how maintaining such books provides a means of showing that the company is no gaging in bribery or other illegal payments. The requirement for internal controls is defu s is defined as being WORKING AROUND FCPA PROVISIONS sufficient to provide reasonable assurance FIGURE 1 ecuted in accordance with management tions are executed in accorda urances that are men's we rization; (b) transactions are recorded as paration of financial statements and to me ability for assets; (c) access to assets is limited to authorization; and (d) the recorded accountable compared with the existing assets at reasonable appropriate action is taken with respect to any difs eded as necesary to per and to maintain sed to managed countability for seasonable interval the respect to any difference oring of transaction Internal controls depend on routine monitoring of hout the firm. They flow from the top the audit com tee of the board, the controller reporting to the board executive officer (CEO) and other executives to the All personnel must be aware of the FCPA when opera international arena: U.S. citizens violating the law abroad prosecuted. The corporation must create a culture of de right thing where leaders show that ethical adherence to the tunt Managers need to understand that they will be fired or severely reprimanded al violators avoid controversy by asking internal board, the child cutives to the bottom Source: htthonour project.com/termba/26816/ ly reprimanded for violations. When word eets out that a company takes the FCPA seriously, potential violators auditors or even the external auditor for guidance. teis critical to establish an organizational climate of integrity, as exemplified in the following 1 External auditors should be used both annually in normal audits and when dealing with larse competitive bidding processes. 2. When corruption needs to be purged, leadership should bring in new accounting staff at all levels, include controller, assistant controller, travel reimbursement specialists, internal auditors, and so forth. 3. An audit committee should be created at the board level independent of the director. The controller should report directly to the audit committee, not to the director, 4. Audits should be publicly communicated. 5. Regular training of partner organizations should take place so that they understand the new culture and rules 6. Regular ethics training should occur with all employees participating. 7. The audit committee of the board should partner with the director in overseeing the culture change 8. The executives should participate in ethics forums at conferences, civic meetings, university.com and the like to show that they care about rooting out corruption. FCPA COMPLIANCE IN THE REAL WORLD ompanies competing in the global arena, is adhering to FCPA like working with your back? Not entirely. For one thing, the United State bribery," and the FCPA is not the only enforcement cy. For one thing, the United States is not the only country with laws aga CPA is not the only enforcement mechanism. But, apart from that mig mg field, effective negotiators and leaders learn to use the political reality and to their benefit without paying bribes. This requires extensive skill. ke working with one hand tied behind untry with laws against foreign from that mitigation of a level play utical reality and the social construction of business the competitive advantage enjoyed by the company permits it to rely on the strength of the prod- rather than a kickback. Beyond this, managers working abroad must develop an understanding problems without paying bribes. Sometimes expatriates have married into the local culture, a Latin America and Asia. Such relationships may give the expatriate access to familial influence hems perhaps a brother-in-law micht step in and encourage an official to approve something instances, the or service sold rathe how to resolve all mon practice in Lati orolve some probleme unded by the company. Expatriate managers a mentor perhaps the Fire playing golf, entertainine can network by serving on boards of not-for-profit organizations favored by the govern she First Lady's preferred charity. They can also, of course, network in the traditional manner by caining, and so forth. Friendships cultivated through these channels can be helpful in resolving sues or problems that may arise. Corporations can also hi at they are incompetent, Son grounds that give them the hired must have real Sell, complying with the exists in the interpretation of will return to this gray area also hire influential people. The risk here is that corporations also have to be able to fire people etent. Sons and daughters of influential local people may have had privileged educational back- ve them the bilingual and multicultural skills needed by the foreign corporation but all people ve real jobs; if the payment is for a sinecure then it is in violation of the FCPA. with the FCPA involves a certain amount of subjective interpretation. A legal and ethical gray area terpretation of the requirements for avoidance of bribery.books and records, and internal controls. We to this gray area and the judgment calls it entails later in the case. PRINCIPLES OF FEDERAL PROSECUTION appens if a company runs afoul of the FCPA? The Department of Justice view of the company depends on are referred to as the principles of federal prosecution, including . Federal law enforcement priorities The nature and seriousness of the offense The deterrent effect of prosecution The person's culpability in connection with the offense The person's history of criminal activity . The person's willingness to cooperate in the investigation or prosecution of others . The probable sentence or other consequences if the person is convicted" One could presume that the naive offentlecright be treated differently than the repeated offender. For example, this case study's first author broke the law s tralia by inadvertently bringing in an apple in his hand luggage. A fruit-sniffing dog discovered the violation, but the official confiscated the apple and let it go after establishing the traveler's ignorance of the law and the relatively minor nature of the violation. However, leniency was not the case for travelers attempting to import drugs to Singapore, where the airlines used to announce upon landing that viola- tors would be executed. ws vary from country to country, as does enforcement. This case study's first author encountered a great of variation in currency trading. In Costa Rica, the Central Bank building was ringed by sidewalk traders legally exchanged small amounts of U.S. dollars for the local currency, colones. Such a transaction in er country could have resulted in a jail sentence. One simply has to be aware of local laws and the U.S. applicable to the circumstance. FCPA does not vary from country to country. Business people have to be it and follow the rules to avoid prosecution. Figure 2 shows FCPA enforcement trends over the years aware of it and follow the rules to av 2004 to 2016 E DO AND SEC ENFORCEMENT ACTIONS DOS and SEC Enforcement Actions Number of Enforcement Action 2001 1999 1997 1999 2003 2000 200.000 DOJ Total: 297 SEC Total: 201 1979 1981 1983 1985 1987 1989 2013 2015 2017 FOREIGN FIRMS REGISTERED IN THE UNITED STATES w often they involve foreign firms operating inte lators to date have been foreign firms, leaving only 3 An interesting aspect of FCPA cases resulting in large fines is how often they involve for United States. As of December 2016, 7 of the top 10 violators to date have been for are based in the United States (see Table 1). The and highest FCPA fine was assessed against the French transportation giant Alstom which in 2014 to a widespread scheme involving tens of millions of dollars' in bribes around the world.Com on that case, R. L. Cassin, founder of the FCPA blog, identified six reasons why French companies like Alston afoul of the FCPA: 1. Alstom did not have an effective anti-bribery compliance program. 2. Alstom's bribery was a way of doing business. 3. Alstom and other non-U.S. companies on the FCPA top 10 list were not hard to catch. 4. Alstom stonewalled the feds. 5. Alstom is from France, a country with a weak enforcement record. 6. A company is more likely to land on the top 10 list when senior executives are culpab TABLE 1 TOP TEN FCPA VIOLATORS Rank Firm Name Country Siemens Year Germany Alstom 2008 France Amount $800 million $772 million $579 milion $519 million KBR/Halliburton USA 2014 2009 TEVA Pharmaceutical Israel Odebrecht/Braskem Brazil 2016 2016 $420 million Och-Ziff USA $412 million 2016 BAE UK $400 million 2010 Total SA France $398 million 2013 9 VimpelCom Netherlands $397.6 million 2016 Alcoa USA $384 million 2014 Data from Cassin, RL (December 29, 2016). TEVA ranks fourth on our new top ten ist FCPA Bog post. Retrieved from http://www Source: Data Wacom/blog/2016/12/29/reconsidered-odebrecht-and-braskem-are-on-our-los-loc-len-Lhtml In 2016, the SEC cited a record number of firms (27) for FCPA violations. Fifteen of the 27 corporate citations were for violations involving Chinese officials or entities. The following firms were fined for bribery in China: Sciclone, PTC, Qualcomm, Novartis, Las Vegas Sands, Akamai Technologies, Nortek, Johnson Controls, AstraZeneca, Nu Skin, HMT LLC, NHC, GlaxoSmithKline plc, JP Morgan, and General Cable Corporation. WHEN DOES PETTY GRAFT BECOME ILLEGAL? It is not always easy drawing the line between petty graft and FCPA violation. Following are six hypothetical sce- narios generally based on real-life situations of a nongovernmental organization (NGO) U.S.expatriate director working in Senegal. Review the following vignettes and decide whether an FCPA violation occurred based on the criteria presented earlier in this case. Scenario 1: Upon arrival in Senegal for an assignment with an NGO, the expatriate director's personal effects sat in crates on the wharf, exposed to the elements and theft. He readily complied with the customs official's request for an additional $100 for overtime. The freight forwarding company had warned him not to pay this surcharge because it was graft, and payment would habituate the customs official to future expectations of graft. Is the addi- tional $100 surcharge payment an FCPA violation? Scenario 2: The Senegalese government assigned a staff member named Amadou to oversee the expatriate direc- of s agency. Amadou asked the director for $75 to repair a vehicle that they could use while awaiting approval or duty-free importation of an organizational vehicle. The director advanced Amadou the money, and Amadou ked to the sky and declared, "God is great." The director thought it curious, but then reflected on the incident alled that Amadou had just told him he was having trouble coming up with the obligatory 100-kilo bag of u owed his first wife. Amadou lived with his younger second wife but still had some responsibility for the first. the director let it go as a miscellaneous vance an FCPA violation? hepext few months, the expatru who reputedly felt he knew a great deal about NGO development program The vehicle repair did not happen, but the director erilen at his job otherwise is the advance an FCPA S e t As the program in Senegal began to grow over the warmed that a board member who reputedly fel Dakar. The director was to meet the board member The director thought it prudent to invite the local regional watation. The director had advanced Sardou the cost of the sono speak to the director immediately before the meetin regret that he had somehow lost the $200 the dir thought that he was trying to double dip, but gave him the here to explain the NGO prog vernmental head, Saidou, to expl the trip (i.c., gas, hotel and meals. In with the board member. He ex am that he how lost the $200 the director had advanced to him for the travel expenses. The che 5200 nonetheless. Sandou then presented violation? director for governmental activities, Issa, sometimes stopped by to set the rural office and home. Ons to pay for tires for his vehicle and some office sts. Are these payments an FCPA violation? office supplies to the board member. Is the $200 payment an FCPA violation Scenario 4: The local regional director for and Amadou. They too reciproca They too reciprocated and visited Issa in his very modest sions, Issa asked the director for assistance to pay for $200 at a time. The director complied with these requests. Are these paym - The NGO grew and its projects were successful. Then one day EIL controlled all hiring in the area, sum about the obligatory four hour wait; he simply brou finally admitted the director to his office just before Elhadji could either do an audit of the NGO Il birine in the area, summoned the director to his office. The directe Flhadi, the local work inspect is office. The director knew enough to paperback book and enjoyed the respite from work director that at this very Performing an immediatt mind even if made up. Elhadji would prefer soo kilometers. The didnt FCPA violate be director to his office just before lunchtime and informed the d or do an audit of the NGO's office or go to Dakar for a meeting. Performing an LNG was a threat by Elhadji, who would then find some violation even if Dale hurt be lacked the $100 needed for gasoline to get there, a round trip of ALL Elhadji $100 in gasoline coupons $100 in gasoline coupons so Elhadji could go to Dakar. Is the $100 gas payment an FCPA contracted with a local carpenter to build school desks. Since the project was Scenario 6: The director contracted with a local carnenter to warrant the purchase of a table saw, the director advanced the carpenter around $10 other materials. The carpenter failed to deliver on time, and it was rumored he was list life than usual. Amadou took note and summoned the carpenter's older male relatives to carpenter into compliance with the contract. This proved successful. The other approach was the police would have beaten the carpenter and jailed him. The director explained all of this to the inte when he visited. Is the initial $10,000 advancement to the carpenter an FCPA violation? around $10,000 to buy the sand d it was rumored he was living a higher standard Critical Thinking Questions 1. Explain whether each of the six payments the director made was either legal or an FCPA violation. If you the director, how would you have addressed ach of these six situations? 2. A foreign firm just listed on the U.S. stock exchange hired you to help with logistics. Outside the United standard business practice is to pay government officials a retainer to sign legal documents that they routinely process. The foreign firm's headquarters abroad can claim these "retainers as business Law firms abroad handle the payment of the "retainers that are billed to your firm as legal fees. To boss working in the United States ordered you to follow the established practice abroad and per What should you do? strict attorney focuses on what she perceives as corrupt business practices. You ben the difference between a facilitation payment and a bribe. The payment you are ab bribe if it were paid to an official, but you a were paid to an official, but you are paving it to a business associate from a priva that would clearly be a bribe had you paid it to an official. Should you py last audit of your firm's foreign subsidiaries resulted in a finding that someo bribes. U.S. officials have not charged you. What should you do? aces. You believe you understand at you are about to make would be om a private firm fora sentit of the payments and we