Question: 4. At time = 0, you enter into a 5-year currency swap agreement in which you will pay $ 2.60% and receive 0.80%. Notional principal

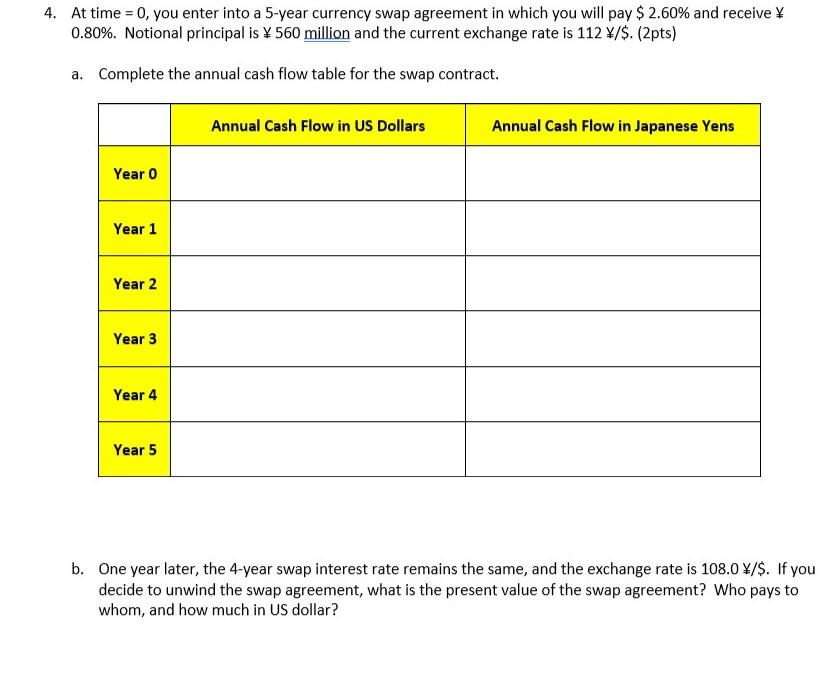

4. At time = 0, you enter into a 5-year currency swap agreement in which you will pay $ 2.60% and receive 0.80%. Notional principal is 560 million and the current exchange rate is 112 /$. (2pts) a. Complete the annual cash flow table for the swap contract. Annual Cash Flow in US Dollars Annual Cash Flow in Japanese Yens Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 b. One year later, the 4-year swap interest rate remains the same, and the exchange rate is 108.0 /$. If you decide to unwind the swap agreement, what is the present value of the swap agreement? Who pays to whom, and how much in US dollar? 4. At time = 0, you enter into a 5-year currency swap agreement in which you will pay $ 2.60% and receive 0.80%. Notional principal is 560 million and the current exchange rate is 112 /$. (2pts) a. Complete the annual cash flow table for the swap contract. Annual Cash Flow in US Dollars Annual Cash Flow in Japanese Yens Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 b. One year later, the 4-year swap interest rate remains the same, and the exchange rate is 108.0 /$. If you decide to unwind the swap agreement, what is the present value of the swap agreement? Who pays to whom, and how much in US dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts