Question: Any help would be much appreciated 3. At time = 0, you enter a 3-year currency swap agreement in which you will receive $ 4.00%

Any help would be much appreciated

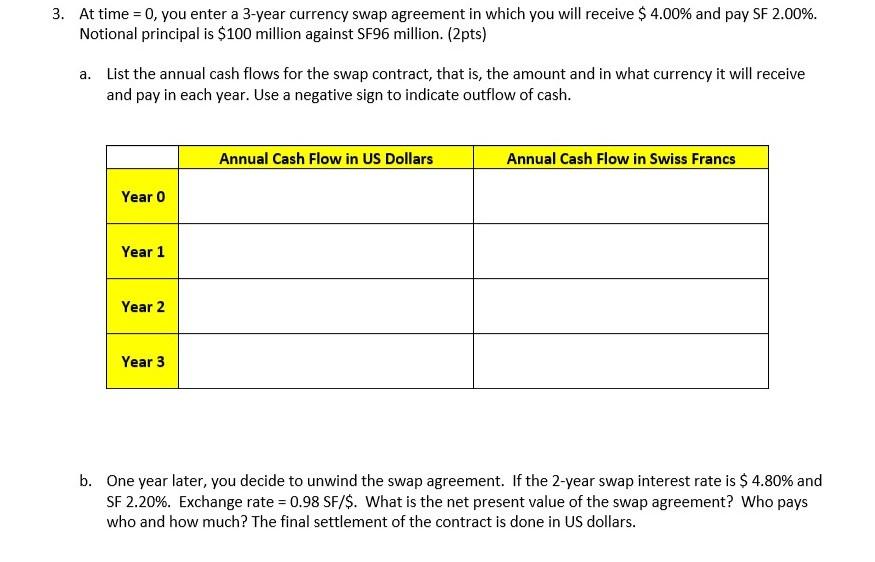

3. At time = 0, you enter a 3-year currency swap agreement in which you will receive $ 4.00% and pay SF 2.00%. Notional principal is $100 million against SF96 million. (2pts) a. List the annual cash flows for the swap contract, that is, the amount and in what currency it will receive and pay in each year. Use a negative sign to indicate outflow of cash. Annual Cash Flow in US Dollars Annual Cash Flow in Swiss Francs Year 0 Year 1 Year 2 Year 3 b. One year later, you decide to unwind the swap agreement. If the 2-year swap interest rate is $ 4.80% and SF 2.20%. Exchange rate = 0.98 SF/$. What is the net present value of the swap agreement? Who pays who and how much? The final settlement of the contract is done in US dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts