Question: 4. Based on the information provided below, complete the table below and answer the following questions: a. Stocks of AA, BB, and CC, initially priced

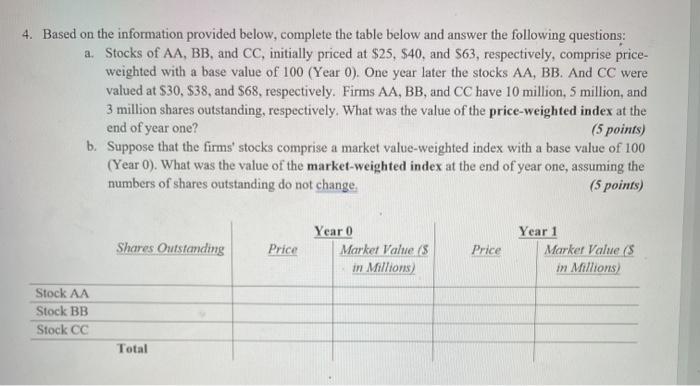

4. Based on the information provided below, complete the table below and answer the following questions: a. Stocks of AA, BB, and CC, initially priced at $25, $40, and $63, respectively, comprise price- weighted with a base value of 100 (Year 0). One year later the stocks AA, BB. And CC were valued at $30, 838, and $68, respectively. Firms AA, BB, and CC have 10 million, 5 million, and 3 million shares outstanding, respectively. What was the value of the price-weighted index at the end of year one? (5 points) b. Suppose that the firms' stocks comprise a market value-weighted index with a base value of 100 (Year O). What was the value of the market-weighted index at the end of year one, assuming the numbers of shares outstanding do not change (5 points) Shares Outstanding Price Year 0 Market Values in Millions Price Year 1 Market Value ($ in Millions) Stock AA Stock BB Stock CC Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts