Question: Company: AMAZON.COM Part I: EPS / EBIT Analysis Determine whether the firm should use all debt, all stock, or a 50-50 combination of debt and

Company: AMAZON.COM

Part I: EPS / EBIT Analysis

- Determine whether the firm should use all debt, all stock, or a 50-50 combination of debt and stock to finance their market-development strategy.

- In 50-100 words, provide a summary recommendation/analysis overview for this part.

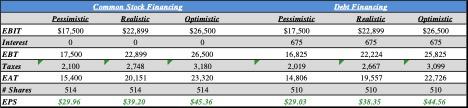

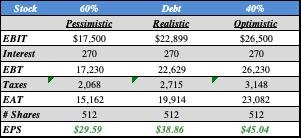

ERIT Interest EBT Taxes EAT Shares EPS Partimistic $17.500 0 17.500 2.100 15.400 514 $29.96 Common Stock Einancing Realistic Gatiuirtic $22,899 526,500 0 0 22.899 26,500 2,748 3.IND 20.151 23,320 514 514 $19.20 S45.36 Pessimistic $17.500 675 16,825 2.019 14,806 510 $29,03 thebt. Einancing Realistic $22.800 675 22,224 2.667 19.557 510 $38.35 Antimistic $26.500 675 25,825 3.099 22,726 510 $44.56 Stock 60% Pessimistic $17.500 270 Debr Realistic $22.899 270 22.629 EBIT Interest Taxes EAT # Shares EPS 40% Optimistic $26.500 270 26,230 3.148 23,082 512 $45.04 17.230 2.068 15.162 512 $29.59 2.715 19.914 512 $38.86 $13,500 5% Amount Needed Interest Rate Tax Rate #Shares Outstanding Additional Shares Outstanding Needed Stock Price 12% 510.0 4.09 $3,298.99

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts