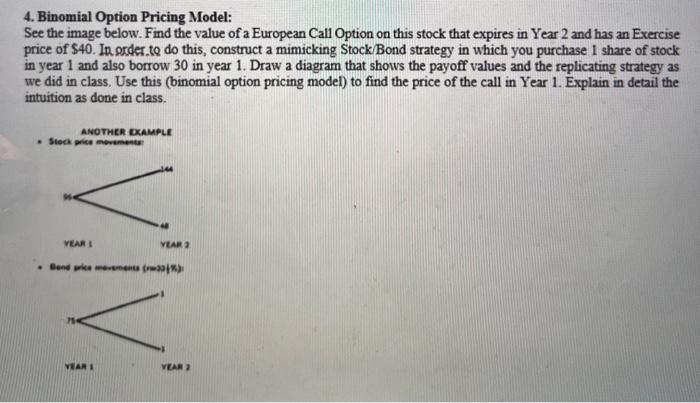

Question: 4. Binomial Option Pricing Model: See the image below. Find the value of a European Call Option on this stock that expires in Year 2

4. Binomial Option Pricing Model: See the image below. Find the value of a European Call Option on this stock that expires in Year 2 and has an Exercise price of $40. In order to do this, construct a mimicking Stock/Bond strategy in which you purchase I share of stock in year 1 and also borrow 30 in year 1. Draw a diagram that shows the payoff values and the replicating strategy as we did in class. Use this (binomial option pricing model) to find the price of the call in Year 1. Explain in detail the intuition as done in class. ANOTHER EXAMPLE Steckprice movement VEAR: VLAR Vily Bendrier) VIARI VEAR 4. Binomial Option Pricing Model: See the image below. Find the value of a European Call Option on this stock that expires in Year 2 and has an Exercise price of $40. In order to do this, construct a mimicking Stock/Bond strategy in which you purchase I share of stock in year 1 and also borrow 30 in year 1. Draw a diagram that shows the payoff values and the replicating strategy as we did in class. Use this (binomial option pricing model) to find the price of the call in Year 1. Explain in detail the intuition as done in class. ANOTHER EXAMPLE Steckprice movement VEAR: VLAR Vily Bendrier) VIARI VEAR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts