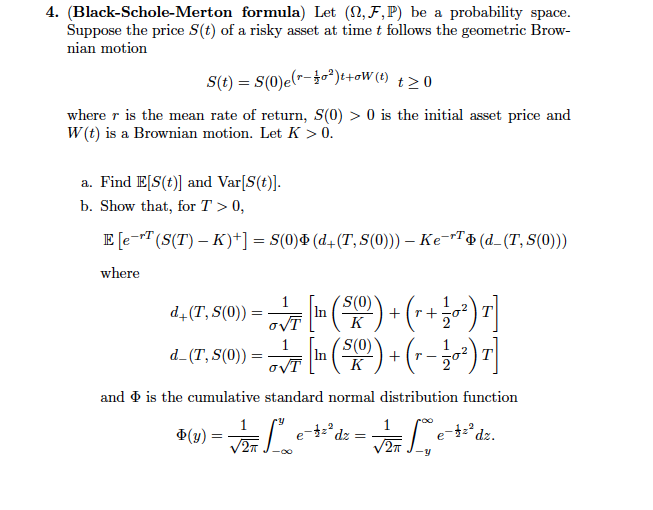

Question: 4. (Black-Schole-Merton formula) Let (2,F,P) be a probability space. Suppose the price S(t) of a risky asset at time t follows the geometric Brow- nian

4. (Black-Schole-Merton formula) Let (2,F,P) be a probability space. Suppose the price S(t) of a risky asset at time t follows the geometric Brow- nian motion s(t) = S(O)(-40%)t+oW (t) +20 where r is the mean rate of return, S(0) > 0 is the initial asset price and W(t) is a Brownian motion. Let K>0. a. Find E[S(t)) and Var($(t)). b. Show that, for T >0, E [e=HT (S(T) K)+] = S(0)6 (d+(T, S(0)) Ke-T (d_(T, S(O)) where d+(T, S(O) OVI L (%") + (- +)1] 1 d_(T, S(O)) 1 OVT In S(0) K + T- and is the cumulative standard normal distribution function +(3) = L **dz = e-+-'da = wa Leo e-+dz. 4. (Black-Schole-Merton formula) Let (2,F,P) be a probability space. Suppose the price S(t) of a risky asset at time t follows the geometric Brow- nian motion s(t) = S(O)(-40%)t+oW (t) +20 where r is the mean rate of return, S(0) > 0 is the initial asset price and W(t) is a Brownian motion. Let K>0. a. Find E[S(t)) and Var($(t)). b. Show that, for T >0, E [e=HT (S(T) K)+] = S(0)6 (d+(T, S(0)) Ke-T (d_(T, S(O)) where d+(T, S(O) OVI L (%") + (- +)1] 1 d_(T, S(O)) 1 OVT In S(0) K + T- and is the cumulative standard normal distribution function +(3) = L **dz = e-+-'da = wa Leo e-+dz

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts