Question: sir, please solve these questions. 5. (12 points) Let ($, F. P) be a probability space. Suppose the price S(t) of a risky asset at

sir, please solve these questions.

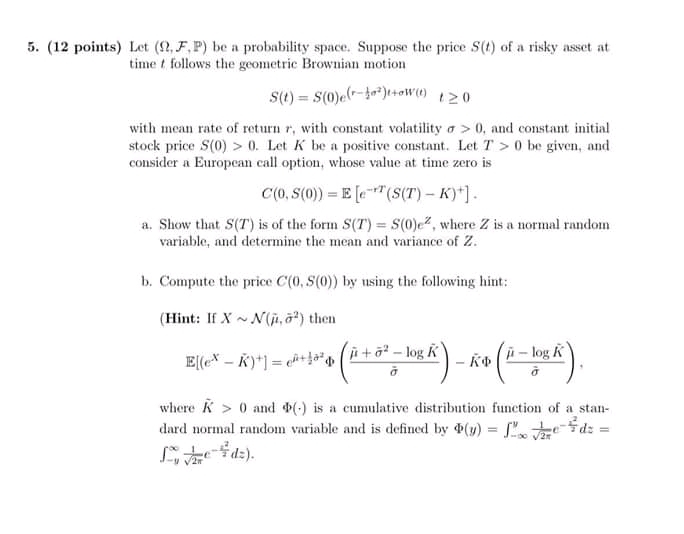

5. (12 points) Let ($, F. P) be a probability space. Suppose the price S(t) of a risky asset at time f follows the geometric Brownian motion S(t) = S(0)e(r-! )tow() 20 with mean rate of return r, with constant volatility a > 0, and constant initial stock price S(0) > 0. Let K be a positive constant. Let 7 > 0 be given, and consider a European call option, whose value at time zero is C(0, S(0)) = Ee (S(T) - K)+]. a. Show that S(7) is of the form S(T) = S(0)ez, where Z is a normal random variable, and determine the mean and variance of Z. b. Compute the price C(0, S(0)) by using the following hint: (Hint: If X ~ N(ji, a') then - Ro # - log K a where K > 0 and (.) is a cumulative distribution function of a stan- dard normal random variable and is defined by (y) = 20 Le Yds =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts