Question: 4 Calstone, Inc., prepares a single, continuous statement of comprehensive income. The following situations occurred during the company's 2018 fiscal year: For each situation below,

4

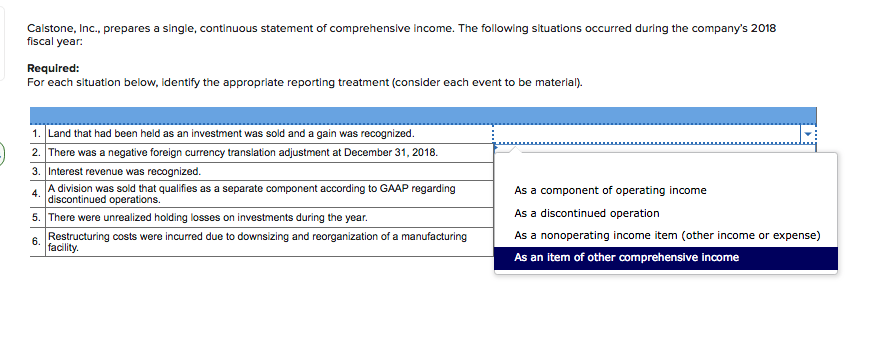

Calstone, Inc., prepares a single, continuous statement of comprehensive income. The following situations occurred during the company's 2018 fiscal year: For each situation below, identlfy the appropriate reporting treatment (consider each event to be materlal). 1. Land that had been held as an investment was sold and a gain was recognized 2. There was a negative foreign currency translation adjustment at December 31, 2018. 3. Interest revenue was recognized. A division was sold that qualifies as a separate component according to GAAP regarding ? discontinued operations. 5. There were unrealized holding losses on investments during the year. 6, Restructuring costs were incurred due to downsizing and reorganization of a manufacturing As a component of operating income As a discontinued operation As a nonoperating income item (other income or expense) As an item of other comprehensive income facility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts