Question: . .. prepares a single, continuous statement of comprehensive income. The following situations occurred during the company's 2018 fiscal year: 1. Land that had been

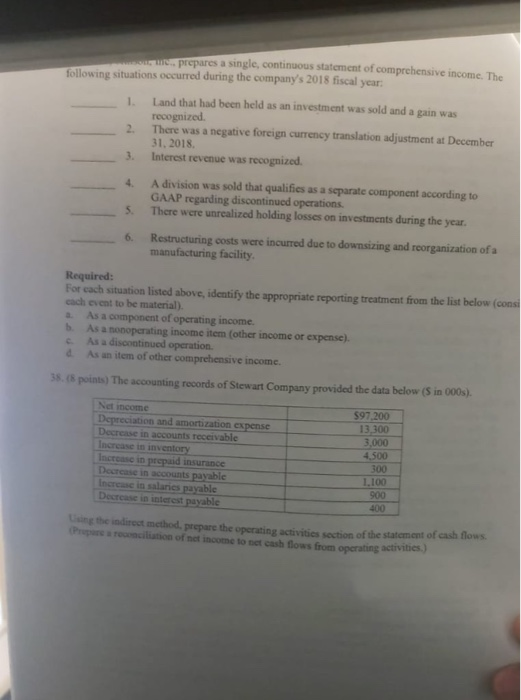

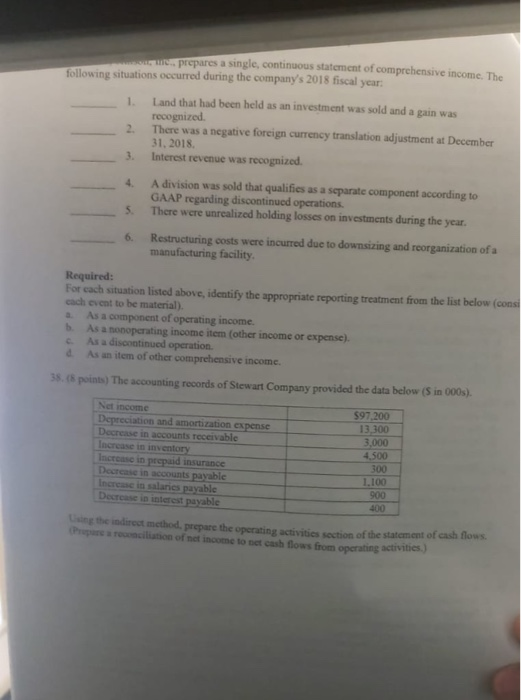

. .. prepares a single, continuous statement of comprehensive income. The following situations occurred during the company's 2018 fiscal year: 1. Land that had been held as an investment was sold and a pain was recognized There was a negative foreign currency translation adjustment at December 31. 2018 Interest revenue was recognized 4 A division was sold that qualities as a separate component according to GAAP regarding discontinued operations. There were unrealized holding losses on investments during the year. 6. Restructuring costs were incurred due to downsizing and reorganization of a manufacturing facility. Required: for each situation listed above, identify the appropriate reporting treatment from the list below (cons each event to be material). As a component of operating income. As monoperating income item (other income or expense As a discontinued operation As an item of other comprehensive income points. The accounting records of Stewart Company provided the data below is in 000 Net income Depreciation and amortization expense Decrease in accounts receivable Increase in inventory Increase in prepaid insurance Decrease in accounts payable Increase in salaries payable Decrease in interest payable $97,200 13.300 3,000 4,500 1.100 900 400 the direct method, prepare the operating activities action of the statement of cash flows. Peperonciation of net income to set cash flows from operating activities) . .. prepares a single, continuous statement of comprehensive income. The following situations occurred during the company's 2018 fiscal year: 1. Land that had been held as an investment was sold and a pain was recognized There was a negative foreign currency translation adjustment at December 31. 2018, Interest revenue was recognized 4. A division was sold that qualifies as a separate component according to GAAP regarding discontinued operations. There were unrealized holding losses on investments during the year. 5. 6. Restructuring costs were incurred due to downsizing and reorganization of a manufacturing facility. Required: for each situation listed above, identify the appropriate reporting treatment from the list below (cons cach event to be material). As a component of operating income. Asanonoperating income item (other income or expense As a discontinued operation As an item of other comprehensive income points. The accounting records of Stewart Company provided the data below is in 000 Net income Depreciation and amortization expense Decrease in accounts receivable Increase in inventory Increase in prepaid insurance Decrease in accounts payable Increase in salaries payable Decrease in interest payable $97,200 13.300 3,000 4,500 300 1.100 900 p the indirect method, prepare the operating activities action of the statement of cash flows. r eciation of net income to net cash flows from operating activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts