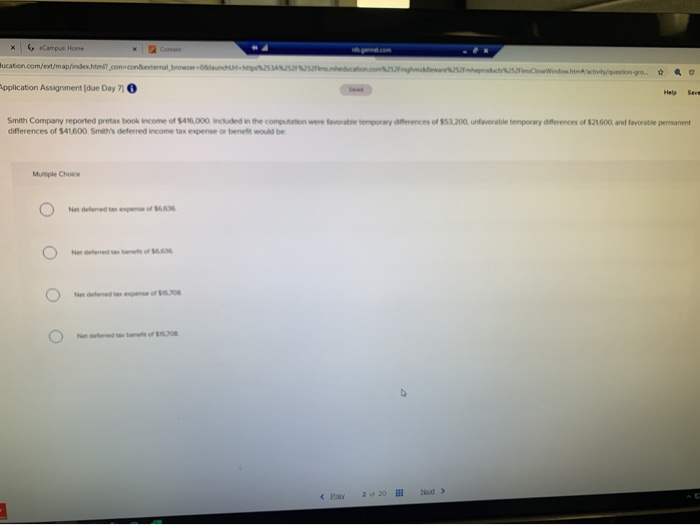

Question: 4, Campus Home mucation.com/et/map/index.html?_conu contexternal bromelancht Application Assignment (due Day 7 hedon.com.product Windows higro. SHE Smith Company reported pretax book income of 5446.000. Included in

4, Campus Home mucation.com/et/map/index.html?_conu contexternal bromelancht Application Assignment (due Day 7 hedon.com.product Windows higro. SHE Smith Company reported pretax book income of 5446.000. Included in the computation were tvorable temporary arterences of $5,200, untuvorable temporary differences of $2.000, and tworable permanent differences of $41600. Smith's deferred income tax expense or benett would be Multiple Choice Net deferred to expense of 666 D 2 20 Nad >

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock