Question: 4. CAPM and Other Factor Models (18 points): CAPM and other factor models are widely applied in the practice of investment management. They simplify portfolio

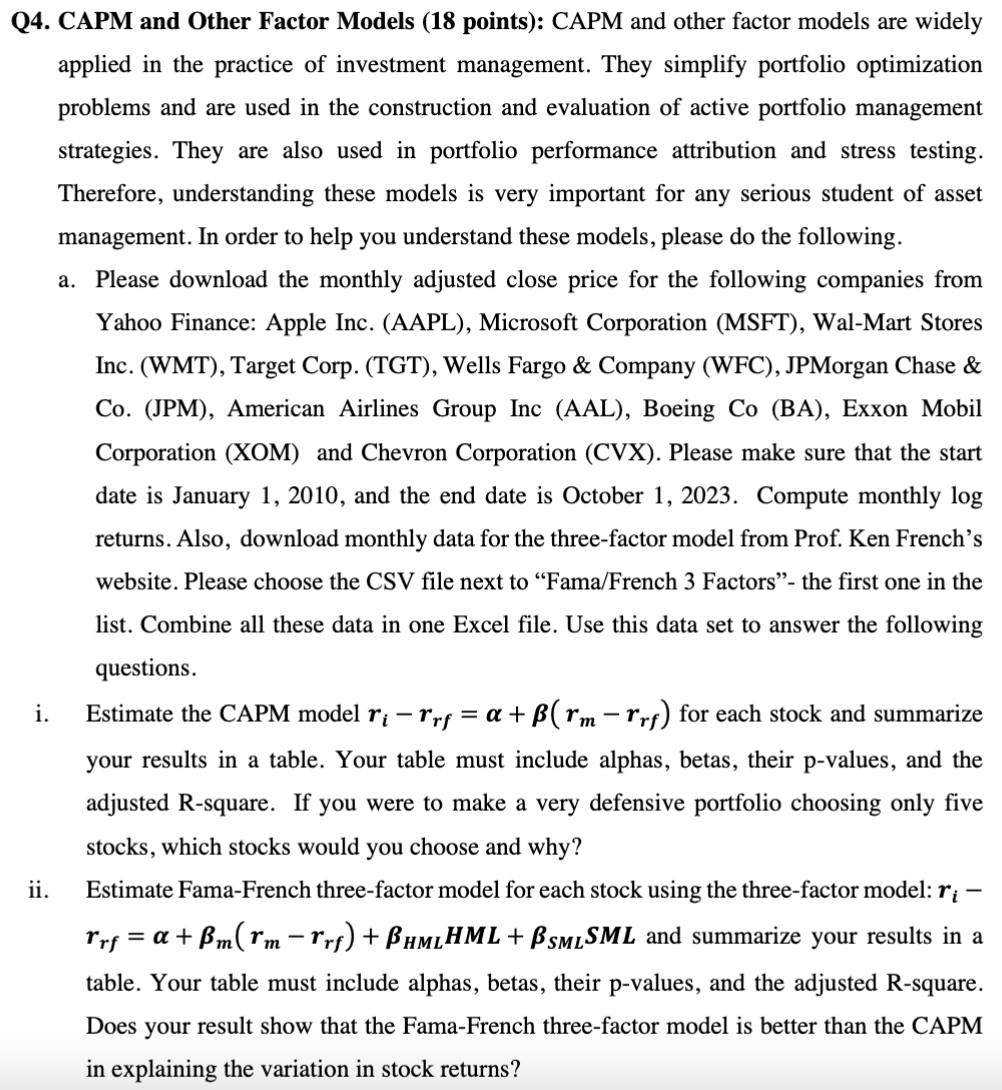

4. CAPM and Other Factor Models (18 points): CAPM and other factor models are widely applied in the practice of investment management. They simplify portfolio optimization problems and are used in the construction and evaluation of active portfolio management strategies. They are also used in portfolio performance attribution and stress testing. Therefore, understanding these models is very important for any serious student of asset management. In order to help you understand these models, please do the following. a. Please download the monthly adjusted close price for the following companies from Yahoo Finance: Apple Inc. (AAPL), Microsoft Corporation (MSFT), Wal-Mart Stores Inc. (WMT), Target Corp. (TGT), Wells Fargo \& Company (WFC), JPMorgan Chase \& Co. (JPM), American Airlines Group Inc (AAL), Boeing Co (BA), Exxon Mobil Corporation (XOM) and Chevron Corporation (CVX). Please make sure that the start date is January 1, 2010, and the end date is October 1, 2023. Compute monthly log returns. Also, download monthly data for the three-factor model from Prof. Ken French's website. Please choose the CSV file next to "Fama/French 3 Factors"- the first one in the list. Combine all these data in one Excel file. Use this data set to answer the following questions. i. Estimate the CAPM model rirrf=+(rmrr) for each stock and summarize your results in a table. Your table must include alphas, betas, their p-values, and the adjusted R-square. If you were to make a very defensive portfolio choosing only five stocks, which stocks would you choose and why? ii. Estimate Fama-French three-factor model for each stock using the three-factor model: ri rrf=+m(rmrrf)+HMLHML+SMLSML and summarize your results in a table. Your table must include alphas, betas, their p-values, and the adjusted R-square. Does your result show that the Fama-French three-factor model is better than the CAPM in explaining the variation in stock returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts