Question: 4. CAPM describes risk-return relation as a straight line in x-y plane (x for risk, measured by either beta or standard deviation; y for expected

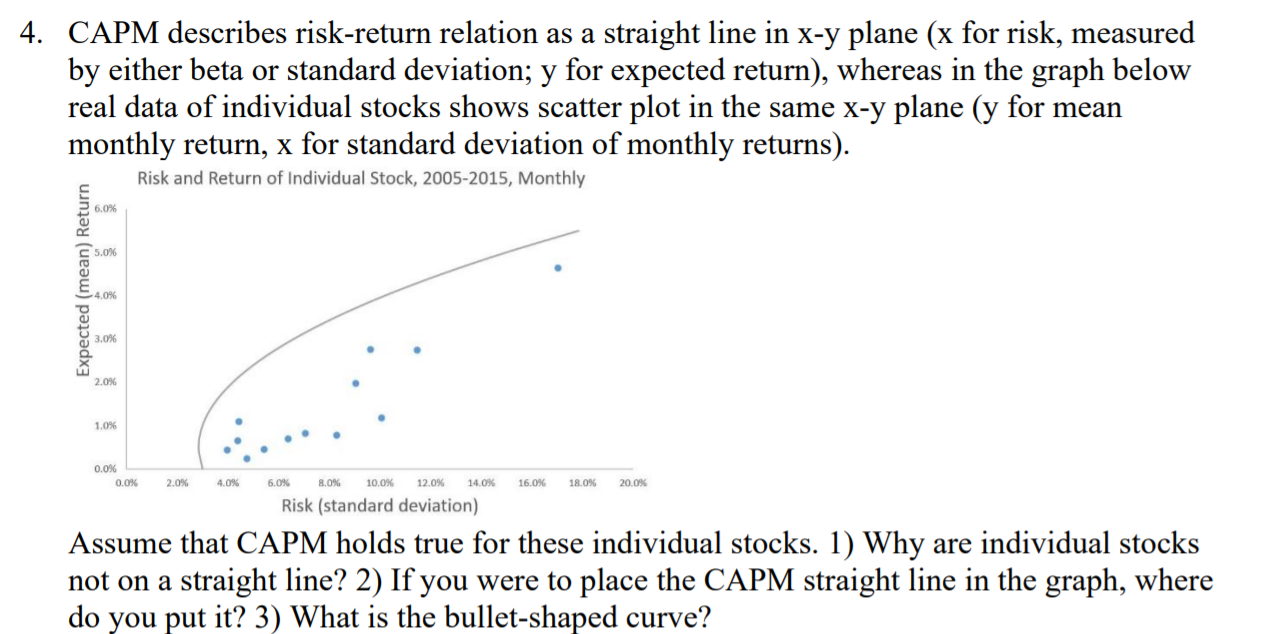

4. CAPM describes risk-return relation as a straight line in x-y plane (x for risk, measured by either beta or standard deviation; y for expected return), whereas in the graph below real data of individual stocks shows scatter plot in the same x-y plane (y for mean monthly return, x for standard deviation of monthly returns). Risk and Return of Individual Stock, 2005-2015, Monthly 6.0% 5.0% Expected (mean) Return -4.0% 3,0% 2.0% 1.0% 0.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% Risk (standard deviation) Assume that CAPM holds true for these individual stocks. 1) Why are individual stocks not on a straight line? 2) If you were to place the CAPM straight line in the graph, where do you put it? 3) What is the bullet-shaped curve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts