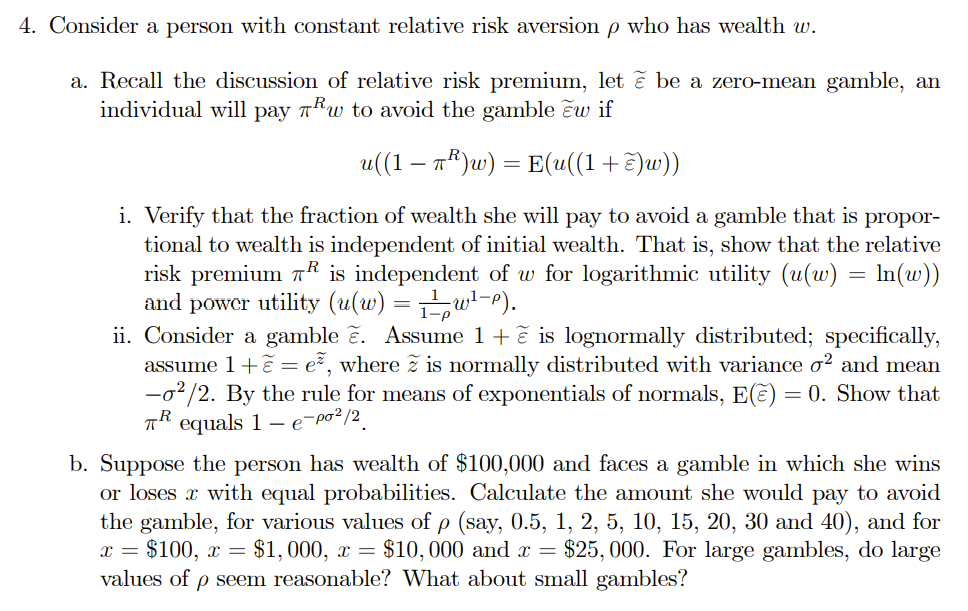

Question: 4. Consider a person with constant relative risk aversion p who has wealth w. a. Recall the discussion of relative risk premium, let be a

4. Consider a person with constant relative risk aversion p who has wealth w. a. Recall the discussion of relative risk premium, let be a zero-mean gamble, an individual will pay aRw to avoid the gamble w if u((1 7R)w) = E(u((1+z)w)) i. Verify that the fraction of wealth she will pay to avoid a gamble that is propor- tional to wealth is independent of initial wealth. That is, show that the relative risk premium aR is independent of w for logarithmic utility (u(w) = ln(w)) and power utility (u(w) = 1-ow!-). ii. Consider a gamble . Assume 1 + is lognormally distributed; specifically, assume 1+ = e, where is normally distributed with variance o2 and mean - 02/2. By the rule for means of exponentials of normals, E() = 0. Show that TR equals 1 - e-po2/2 b. Suppose the person has wealth of $100,000 and faces a gamble in which she wins or loses x with equal probabilities. Calculate the amount she would pay to avoid the gamble, for various values of p (say, 0.5, 1, 2, 5, 10, 15, 20, 30 and 40), and for $100, x= $1,000, x = $10,000 and x = $25,000. For large gambles, do large values of p seem reasonable? What about small gambles? = 4. Consider a person with constant relative risk aversion p who has wealth w. a. Recall the discussion of relative risk premium, let be a zero-mean gamble, an individual will pay aRw to avoid the gamble w if u((1 7R)w) = E(u((1+z)w)) i. Verify that the fraction of wealth she will pay to avoid a gamble that is propor- tional to wealth is independent of initial wealth. That is, show that the relative risk premium aR is independent of w for logarithmic utility (u(w) = ln(w)) and power utility (u(w) = 1-ow!-). ii. Consider a gamble . Assume 1 + is lognormally distributed; specifically, assume 1+ = e, where is normally distributed with variance o2 and mean - 02/2. By the rule for means of exponentials of normals, E() = 0. Show that TR equals 1 - e-po2/2 b. Suppose the person has wealth of $100,000 and faces a gamble in which she wins or loses x with equal probabilities. Calculate the amount she would pay to avoid the gamble, for various values of p (say, 0.5, 1, 2, 5, 10, 15, 20, 30 and 40), and for $100, x= $1,000, x = $10,000 and x = $25,000. For large gambles, do large values of p seem reasonable? What about small gambles? =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts