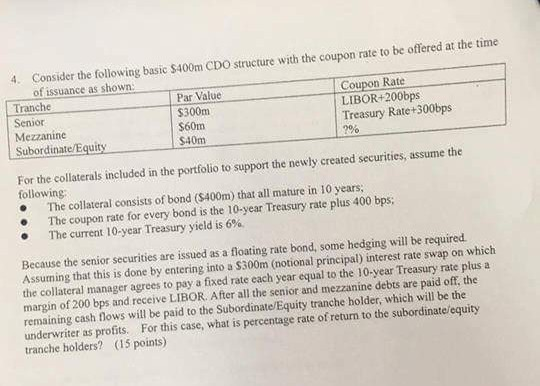

Question: 4. Consider the following basic $400m CDO structure with the coupon rate to be offered at the time of issuance as shown Tranche Senior Mezzanine

4. Consider the following basic $400m CDO structure with the coupon rate to be offered at the time of issuance as shown Tranche Senior Mezzanine Subordinate/Equity Coupon Rate LIBOR+200bps Treasury Rate+300bps Par Value $300m $60m $40m For the collaterals included in the portfolio to support the newly created securities, following The collateral consists of bond ($400m) that all mature in 10 years: The coupon rate for every bond is the 10-year Treasury rate plus 400 bps; The current 10-year Treasury yield is 6 % assume the Because the senior securities are issued as a floating rate bond, some hedging will be required Assuming that this is done by entering into a $300m (notional principal) interest rate swap on which the collateral manager agrees to pay a fixed rate each year equal to the 10-year Treasury rate plus a margin of 200 bps and receive LIBOR. After all the senior and mezzanine debts are paid off, the remaining cash flows will be paid to the Subordinate/Equity tranche holder, which will be the underwriter as profits. For this case, what is percentage rate of return to the subordinate/equity tranche holders? (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts