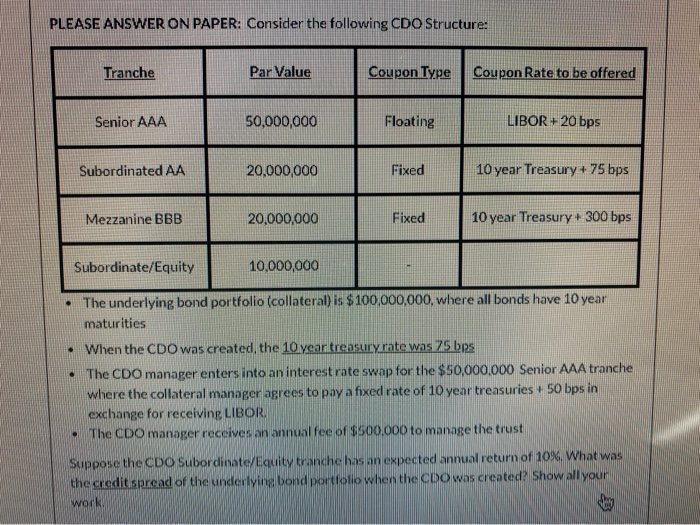

Question: Need help with this question PLEASE ANSWER ON PAPER: Consider the following CDO Structure: Tranche Par Value Coupon Type Coupon Rate to be offered Senior

PLEASE ANSWER ON PAPER: Consider the following CDO Structure: Tranche Par Value Coupon Type Coupon Rate to be offered Senior AAA 50,000,000 Floating LIBOR + 20 bps Subordinated AA 20,000,000 Fixed 10 year Treasury + 75 bps Mezzanine BBB 20,000,000 Fixed 10 year Treasury 300 bps Subordinate/Equity 10,000,000 The underlying bond portfolio (collateral) is $100,000,000, where all bonds have 10 year maturities When the CDO was created, the 10 year treasury rate was 75 brs The CDO manager enters into an interest rate swap for the $50,000,000 Senior AAA tranche where the collateral manager agrees to pay a fixed rate of 10 year treasuries 50 bps in exchange for receiving LIBOR The CDO manager receives an annual fee of $500.000 to manage the trust Suppose the CDO Subordinate/Equity tranche has an expected annual return of 10%. What was the credit spread of the underlying bond portfolio when the CDO was created? Show all your work PLEASE ANSWER ON PAPER: Consider the following CDO Structure: Tranche Par Value Coupon Type Coupon Rate to be offered Senior AAA 50,000,000 Floating LIBOR + 20 bps Subordinated AA 20,000,000 Fixed 10 year Treasury + 75 bps Mezzanine BBB 20,000,000 Fixed 10 year Treasury 300 bps Subordinate/Equity 10,000,000 The underlying bond portfolio (collateral) is $100,000,000, where all bonds have 10 year maturities When the CDO was created, the 10 year treasury rate was 75 brs The CDO manager enters into an interest rate swap for the $50,000,000 Senior AAA tranche where the collateral manager agrees to pay a fixed rate of 10 year treasuries 50 bps in exchange for receiving LIBOR The CDO manager receives an annual fee of $500.000 to manage the trust Suppose the CDO Subordinate/Equity tranche has an expected annual return of 10%. What was the credit spread of the underlying bond portfolio when the CDO was created? Show all your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts