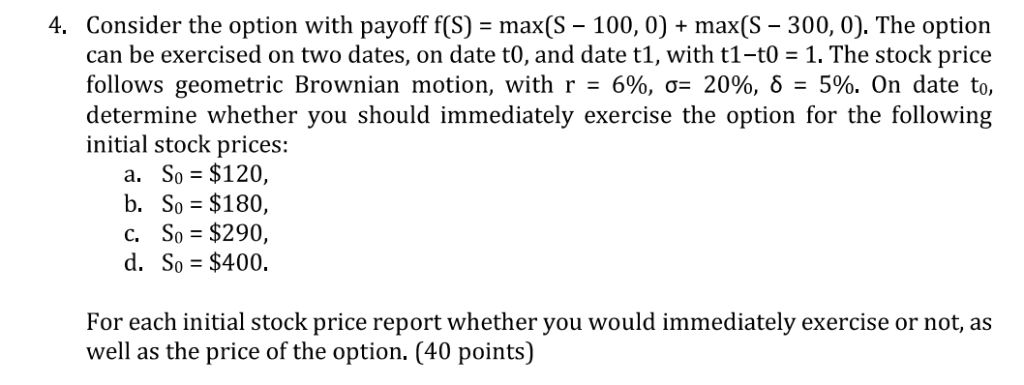

Question: 4. Consider the option with payoff f(S) max(S 100, 0)max(S 300, 0). The option can be exercised on two dates, on date t0, and date

4. Consider the option with payoff f(S) max(S 100, 0)max(S 300, 0). The option can be exercised on two dates, on date t0, and date t1, with t1-t0-1. The stock price follows geometric Brownian motion, with r-6%, -20%, -590. On date to, determine whether you should immediately exercise the option for the following initial stock prices: a. So = $120, b. So $180, C, So = $290, d. So $400. For each initial stock price report whether you would immediately exercise or not, as well as the price of the option. (40 points) 4. Consider the option with payoff f(S) max(S 100, 0)max(S 300, 0). The option can be exercised on two dates, on date t0, and date t1, with t1-t0-1. The stock price follows geometric Brownian motion, with r-6%, -20%, -590. On date to, determine whether you should immediately exercise the option for the following initial stock prices: a. So = $120, b. So $180, C, So = $290, d. So $400. For each initial stock price report whether you would immediately exercise or not, as well as the price of the option. (40 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts