Question: Consider the option with payoff f(S) - max(S - 100, 0) + max(S - 300, 0). The option can be exercised on two dates, on

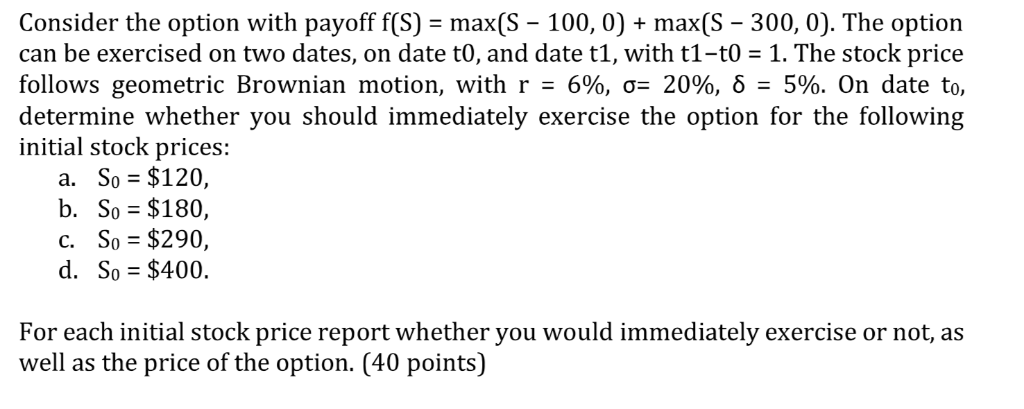

Consider the option with payoff f(S) - max(S - 100, 0) + max(S - 300, 0). The option can be exercised on two dates, on date t0, and date t1, with t1-t0 -1. The stock price follows geometric Brownian motion, with r-6%, - 20%, - 5%. On date to, determine whether you should immediately exercise the option for the following initial stock prices: a. So - $120, b. So $180, c. So $290, d. So - $400 For each initial stock price report whether you would immediately exercise or not, as well as the price of the option. (40 points) Consider the option with payoff f(S) - max(S - 100, 0) + max(S - 300, 0). The option can be exercised on two dates, on date t0, and date t1, with t1-t0 -1. The stock price follows geometric Brownian motion, with r-6%, - 20%, - 5%. On date to, determine whether you should immediately exercise the option for the following initial stock prices: a. So - $120, b. So $180, c. So $290, d. So - $400 For each initial stock price report whether you would immediately exercise or not, as well as the price of the option. (40 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts