Question: #4 COST CUTTING COMPUTER SYSTEM (3PTS) - Your firm is contemplating the purchase of a new $1,049,000 computer-based order entry system. The system will be

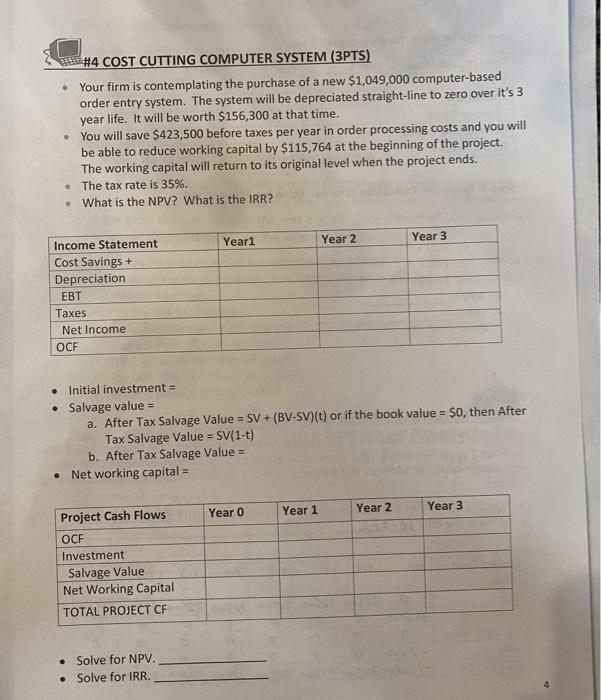

\#4 COST CUTTING COMPUTER SYSTEM (3PTS) - Your firm is contemplating the purchase of a new $1,049,000 computer-based order entry system. The system will be depreciated straight-line to zero over it's 3 year life. It will be worth $156,300 at that time. - You will save $423,500 before taxes per year in order processing costs and you will be able to reduce working capital by $115,764 at the beginning of the project. The working capital will return to its original level when the project ends. - The tax rate is 35%. - What is the NPV? What is the IRR? - Initial investment = - Salvage value = a. After Tax Salvage Value =SV+(BVSV)(t) or if the book value =$0, then After Tax Salvage Value =SV(1t) b. After Tax Salvage Value = - Net working capital = - Solve for NPV. - Solve for IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts