Question: #4. Dan's basic in the noncash property?#5. After distribution, elsie's bases in a/r, land, and partnership interest? 4. Dan receives a proportionate current (non-liquidating) distribution

#4. Dan's basic in the noncash property?#5. After distribution, elsie's bases in a/r, land, and partnership interest?

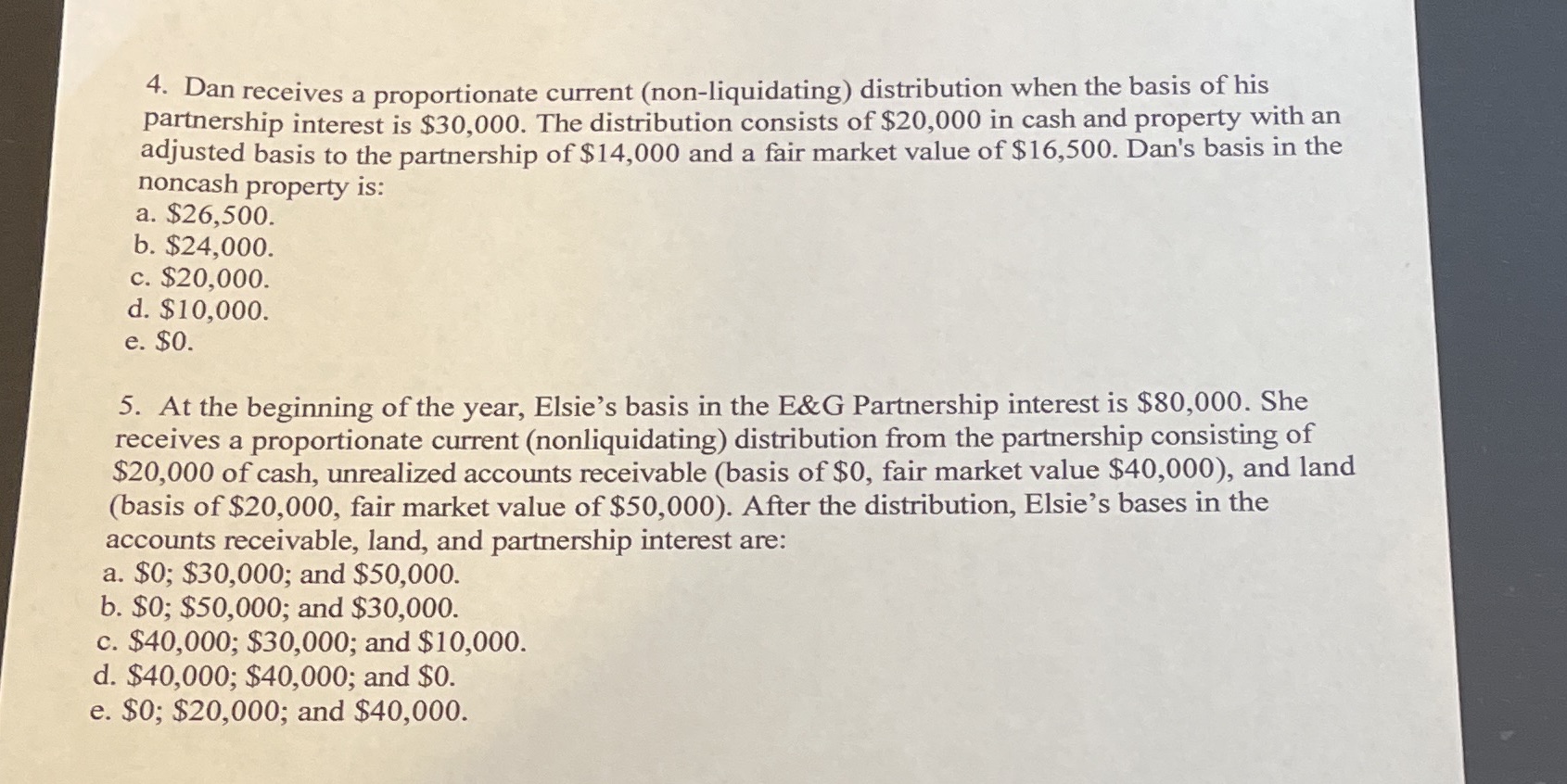

4. Dan receives a proportionate current (non-liquidating) distribution when the basis of his partnership interest is $30,000. The distribution consists of $20,000 in cash and property with an adjusted basis to the partnership of $14,000 and a fair market value of $16,500. Dan's basis in the noncash property is: a. $26,500. b. $24,000. c. $20,000. d. $10,000. e. $0. 5. At the beginning of the year, Elsie's basis in the E&G Partnership interest is $80,000. She receives a proportionate current (nonliquidating) distribution from the partnership consisting of $20,000 of cash, unrealized accounts receivable (basis of $0, fair market value $40,000), and land (basis of $20,000, fair market value of $50,000). After the distribution, Elsie's bases in the accounts receivable, land, and partnership interest are: a. $0; $30,000; and $50,000. b. $0; $50,000; and $30,000. c. $40,000; $30,000; and $10,000. d. $40,000; $40,000; and $0. e. $0; $20,000; and $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts