Question: 4. Equal Risk Parity. It is argued that in the commonly used 60/40 port- folio (60% stocks, 40% bonds), since stocks are much riskier than

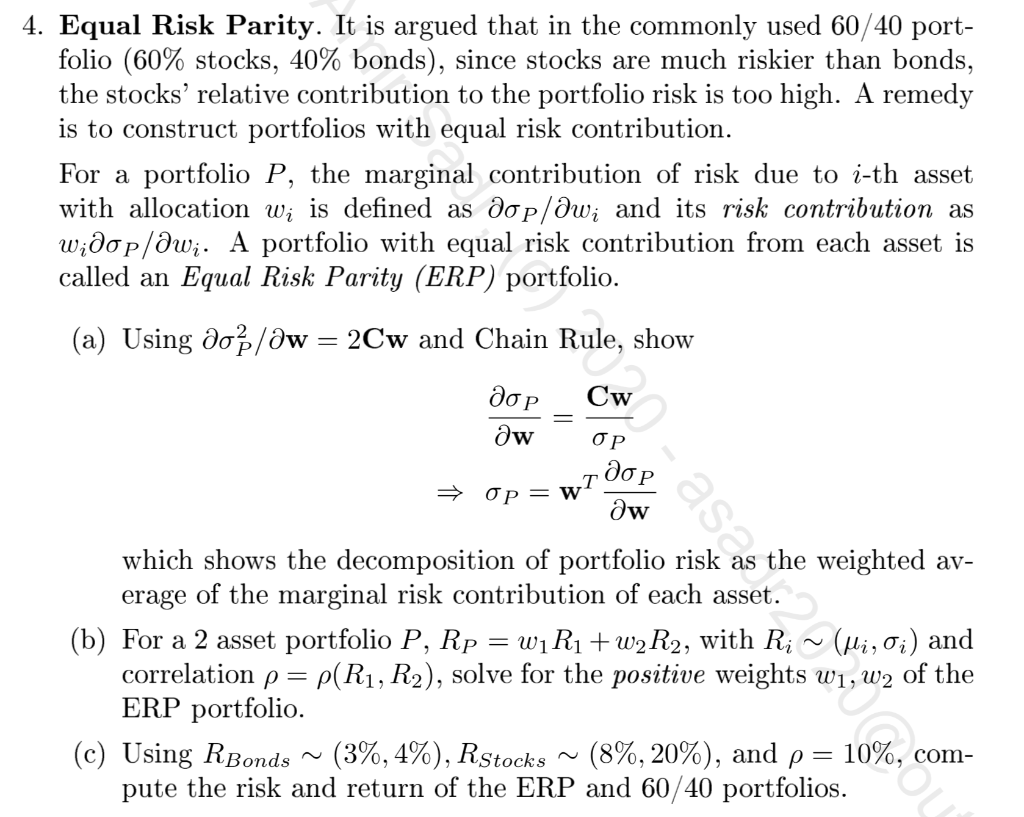

4. Equal Risk Parity. It is argued that in the commonly used 60/40 port- folio (60% stocks, 40% bonds), since stocks are much riskier than bonds, the stocks relative contribution to the portfolio risk is too high. A remedy is to construct portfolios with equal risk contribution. For a portfolio P, the marginal contribution of risk due to i-th asset with allocation wi is defined as dop/dwi and its risk contribution as Widop/awi. A portfolio with equal risk contribution from each asset is called an Equal Risk Parity (ERP) portfolio. (a) Using doslaw = 2Cw and Chain Rule, show aw . > OP= w T w 7 which shows the decomposition of portfolio risk as the weighted av- erage of the marginal risk contribution of each asset. (b) For a 2 asset portfolio P, Rp = wR1 +w2R2, with Ri ~ (Mi, 0i) and correlation p= P(R1, R2), solve for the positive weights w1, W2 of the ERP portfolio. (c) Using RBonds ~ (3%, 4%), RStocks (8%, 20%), and p= 10%, com- pute the risk and return of the ERP and 60/40 portfolios. M 4. Equal Risk Parity. It is argued that in the commonly used 60/40 port- folio (60% stocks, 40% bonds), since stocks are much riskier than bonds, the stocks relative contribution to the portfolio risk is too high. A remedy is to construct portfolios with equal risk contribution. For a portfolio P, the marginal contribution of risk due to i-th asset with allocation wi is defined as dop/dwi and its risk contribution as Widop/awi. A portfolio with equal risk contribution from each asset is called an Equal Risk Parity (ERP) portfolio. (a) Using doslaw = 2Cw and Chain Rule, show aw . > OP= w T w 7 which shows the decomposition of portfolio risk as the weighted av- erage of the marginal risk contribution of each asset. (b) For a 2 asset portfolio P, Rp = wR1 +w2R2, with Ri ~ (Mi, 0i) and correlation p= P(R1, R2), solve for the positive weights w1, W2 of the ERP portfolio. (c) Using RBonds ~ (3%, 4%), RStocks (8%, 20%), and p= 10%, com- pute the risk and return of the ERP and 60/40 portfolios. M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts