Question: Please answer all parts (a)-(c). (3 pts) Equal Risk Parity. It is argued that in the commonly used 60/40 portfolio (60% stocks, 40% bonds), since

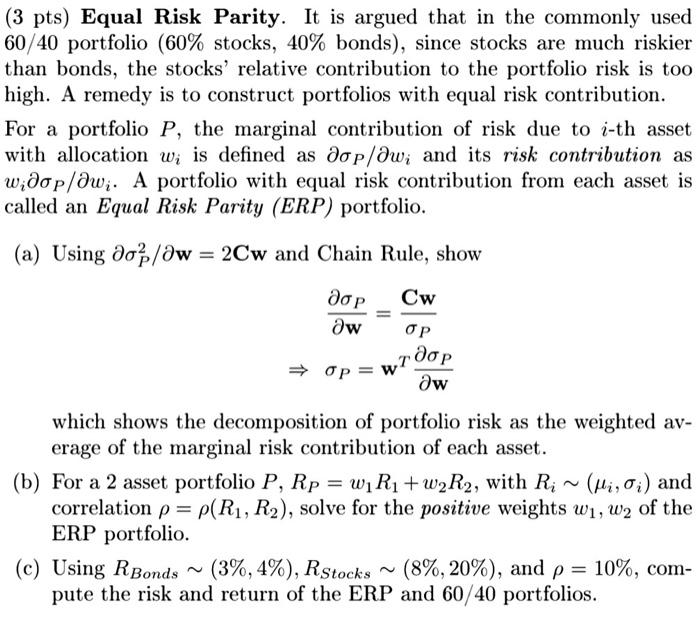

(3 pts) Equal Risk Parity. It is argued that in the commonly used 60/40 portfolio (60% stocks, 40% bonds), since stocks are much riskier than bonds, the stocks' relative contribution to the portfolio risk is too high. A remedy is to construct portfolios with equal risk contribution. For a portfolio P, the marginal contribution of risk due to i-th asset with allocation wi is defined as aop/aw; and its risk contribution as widoplawi. A portfolio with equal risk contribution from each asset is called an Equal Risk Parity (ERP) portfolio. (a) Using dalaw = 2Cw and Chain Rule, show Cw aw Op Op=w aw which shows the decomposition of portfolio risk as the weighted av- erage of the marginal risk contribution of each asset. (b) For a 2 asset portfolio P, Rp = w1R1+w2R2, with R; ~ (Mi, 0;) and correlation p= P(R1, R2), solve for the positive weights w1, W2 of the ERP portfolio. (c) Using RBonds~ (3%, 4%), RStocks (8%, 20%), and p = 10%, com- pute the risk and return of the ERP and 60/40 portfolios. (3 pts) Equal Risk Parity. It is argued that in the commonly used 60/40 portfolio (60% stocks, 40% bonds), since stocks are much riskier than bonds, the stocks' relative contribution to the portfolio risk is too high. A remedy is to construct portfolios with equal risk contribution. For a portfolio P, the marginal contribution of risk due to i-th asset with allocation wi is defined as aop/aw; and its risk contribution as widoplawi. A portfolio with equal risk contribution from each asset is called an Equal Risk Parity (ERP) portfolio. (a) Using dalaw = 2Cw and Chain Rule, show Cw aw Op Op=w aw which shows the decomposition of portfolio risk as the weighted av- erage of the marginal risk contribution of each asset. (b) For a 2 asset portfolio P, Rp = w1R1+w2R2, with R; ~ (Mi, 0;) and correlation p= P(R1, R2), solve for the positive weights w1, W2 of the ERP portfolio. (c) Using RBonds~ (3%, 4%), RStocks (8%, 20%), and p = 10%, com- pute the risk and return of the ERP and 60/40 portfolios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts