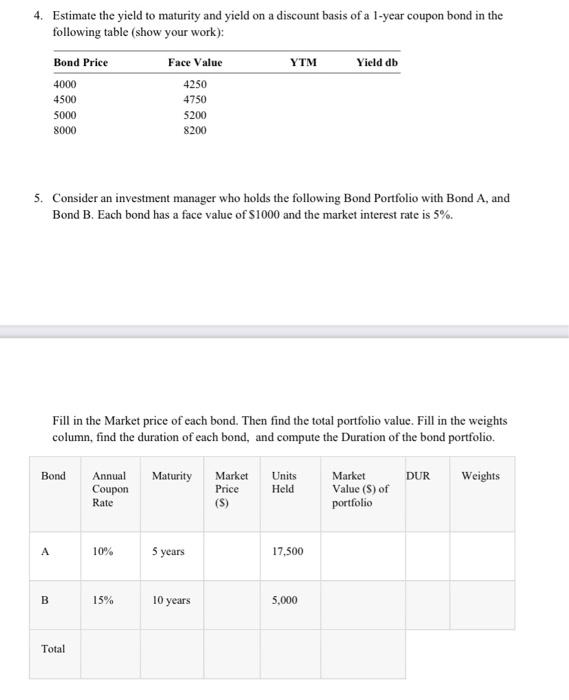

Question: 4. Estimate the yield to maturity and yield on a discount basis of a 1-year coupon bond in the following table (show your work): YTM

4. Estimate the yield to maturity and yield on a discount basis of a 1-year coupon bond in the following table (show your work): YTM Yield db Bond Price 4000 4500 5000 8000 Face Value 4250 4750 5200 8200 5. Consider an investment manager who holds the following Bond Portfolio with Bond A, and Bond B. Each bond has a face value of S1000 and the market interest rate is 5%. Fill in the Market price of each bond. Then find the total portfolio value. Fill in the weights column, find the duration of each bond, and compute the Duration of the bond portfolio. Bond Maturity DUR Annual Coupon Rate Weights Market Price (S) Units Held Market Value (S) of portfolio A 10% 5 years 17,500 B 15% 10 years 5,000 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts