Question: (4) Exercise 4 (A 1-step 3-state model). Consider a 1-step 3-state model, where there are three possi- ble time evolution w1,W2,63 and a stock with

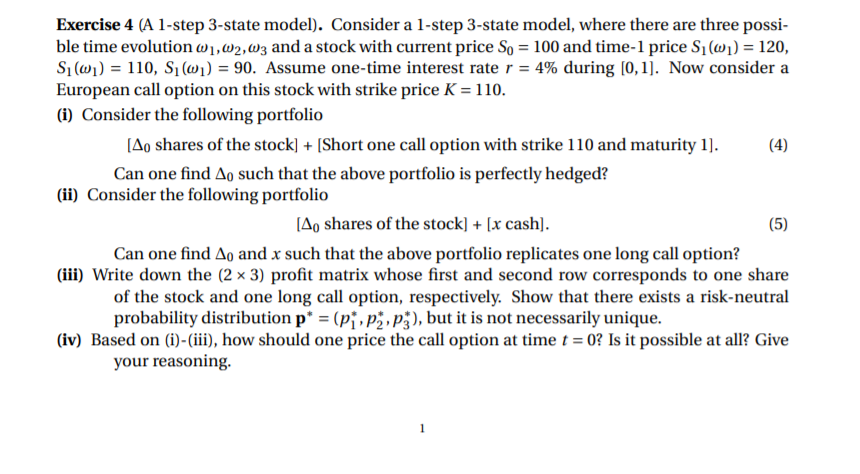

(4) Exercise 4 (A 1-step 3-state model). Consider a 1-step 3-state model, where there are three possi- ble time evolution w1,W2,63 and a stock with current price So = 100 and time 1 price Sw]) = 120, Swi) = 110, S.W]) = 90. Assume one-time interest rate r = 4% during (0,1). Now consider a European call option on this stock with strike price K = 110. (i) Consider the following portfolio [40 shares of the stock] + [Short one call option with strike 110 and maturity 1]. Can one find Ao such that the above portfolio is perfectly hedged? (ii) Consider the following portfolio [40 shares of the stock] + [x cash). (5) Can one find Ao and x such that the above portfolio replicates one long call option? (iii) Write down the (2 x 3) profit matrix whose first and second row corresponds to one share of the stock and one long call option, respectively. Show that there exists a risk-neutral probability distribution p* = (P1, P2, ), but it is not necessarily unique. (iv) Based on (i)-(iii), how should one price the call option at time t = 0? Is it possible at all? Give your reasoning 1 (4) Exercise 4 (A 1-step 3-state model). Consider a 1-step 3-state model, where there are three possi- ble time evolution w1,W2,63 and a stock with current price So = 100 and time 1 price Sw]) = 120, Swi) = 110, S.W]) = 90. Assume one-time interest rate r = 4% during (0,1). Now consider a European call option on this stock with strike price K = 110. (i) Consider the following portfolio [40 shares of the stock] + [Short one call option with strike 110 and maturity 1]. Can one find Ao such that the above portfolio is perfectly hedged? (ii) Consider the following portfolio [40 shares of the stock] + [x cash). (5) Can one find Ao and x such that the above portfolio replicates one long call option? (iii) Write down the (2 x 3) profit matrix whose first and second row corresponds to one share of the stock and one long call option, respectively. Show that there exists a risk-neutral probability distribution p* = (P1, P2, ), but it is not necessarily unique. (iv) Based on (i)-(iii), how should one price the call option at time t = 0? Is it possible at all? Give your reasoning 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts