Question: 4. Financial ratios in the forecasting process Aa Aa Atlantic Northern Inc. currently has $620,000 in accounts receivable and generated $4,350,000 in sales (all on

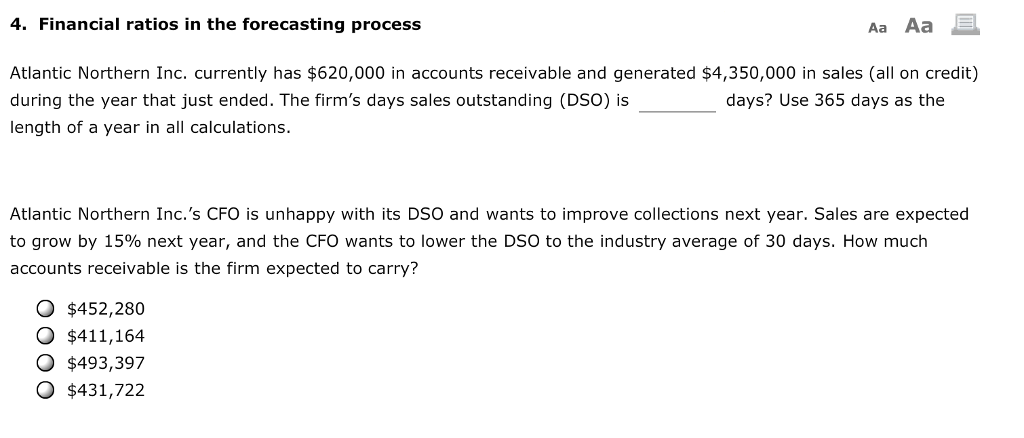

4. Financial ratios in the forecasting process Aa Aa Atlantic Northern Inc. currently has $620,000 in accounts receivable and generated $4,350,000 in sales (all on credit) during the year that just ended. The firm's days sales outstanding (DSO) is length of a year in all calculations. days? Use 365 days as the Atlantic Northern Inc.'s CFO is unhappy with its DSO and wants to improve collections next year. Sales are expected to grow by 15% next year, and the CFO wants to lower the DSO to the industry average of 30 days. How much accounts receivable is the firm expected to carry? $452,280 $411,164 O $493,397 O $431,722

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts