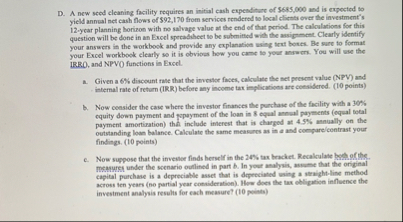

Question: D . A new seced cleaning facility requires an initial cash expenditare of 5 6 8 5 , 0 0 0 and is expected to

D A new seced cleaning facility requires an initial cash expenditare of and is expected to yield annal net cash flows of $ from services rendered to local cliembs over the investment's ycar planning horizon with no salvape value at the end of that period. The calloulations for this question will he done in an Excel specadsheet to be submitned with the assignment Clearly identify your answers in the workbook and provide ary explanatioe asing trat boves. Be sure to format your Excel workbock clearly it is obviers how you came lo your anowerk. You will ese the IRRO, and NPVO functions in Evoct.

a Given a discount rate that the investor facs, calsulate the net present value NPY and ieternal rate of return IRR before any income tax implications are coesidened. points

b Now coesider the cave where the investor finathees the purchase of the facilify with a cquity down payment and wapayment of the loan in equal monall payments oqual botal payment amortiration tha include interest that is charged at manually on the outstanding loan balance. Calculate the same mearors at it et wad cemparelcontrast your findings. points

c Now suppose that the investoe finds herself in the tas hracket. Recalculate bothof the. mesoures under the socnario outlined in part b In your analysis, aswame that the orginal across ten years no partial year conaideration Hew does the tas obligation infleence the investment analysis results for each measure? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock