Question: 4) Forecasting with a Forward Rate. Assume that the four year annualized interest rate in the United States is 9 percent and the four year

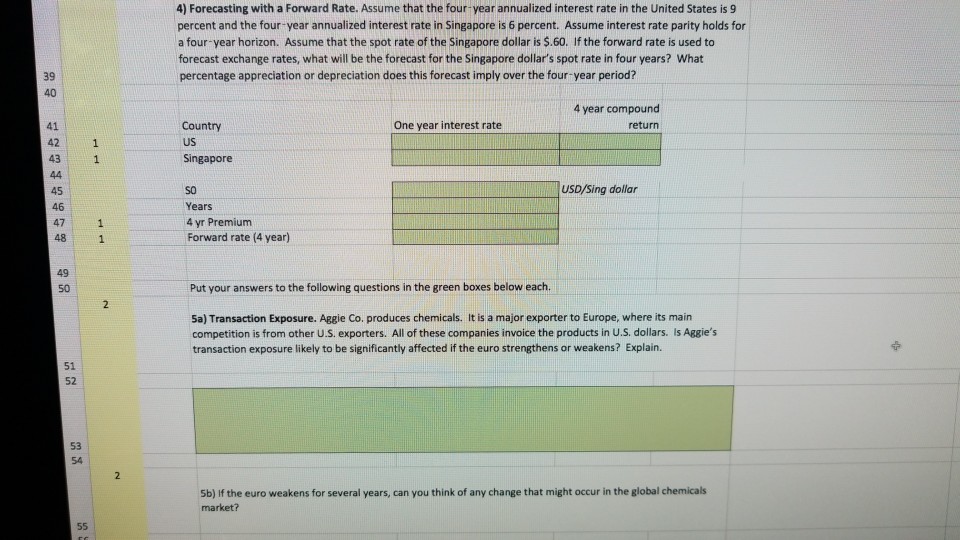

4) Forecasting with a Forward Rate. Assume that the four year annualized interest rate in the United States is 9 percent and the four year annualized interest rate in Singapore is 6 percent. Assume interest rate parity holds for a four-year horizon. Assume that the spot rate of the Singapore dollar is $.60. If the forward rate is used to forecast exchange rates, what will be the forecast for the Singapore dollar's spot rate in four years? What percentage appreciation or depreciation does this forecast imply over the four year period? 39 40 4 year compound One year interest rate 41 42 43 Country US Singapore USD/Sing dollar 45 46 47 48 so Years 4 yr Premium Forward rate (4 year) 49 50 Put your answers to the following questions in the green boxes below each. 5a) Transaction Exposure. Aggie Co. produces chemicals. It is a major exporter to Europe, where its main competition is from other U.S. exporters. All of these companies invoice the products in U.S. dollars. Is Aggie's transaction exposure likely to be significantly affected if the euro strengthens or weakens? Explain. 51 52 53 Sb) If the euro weakens for several years, can you think of any change that might occur in the global chemicals market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts