Question: (4) Given the zero prices obtained in (1) above, what should be the price of a 2-year T-note with 7.5% annual coupon (also paid semi-annually)

(4) Given the zero prices obtained in (1) above, what should be the price of a 2-year T-note with 7.5% annual coupon (also paid semi-annually) with $1,000 par value per share?

(4) Given the zero prices obtained in (1) above, what should be the price of a 2-year T-note with 7.5% annual coupon (also paid semi-annually) with $1,000 par value per share?

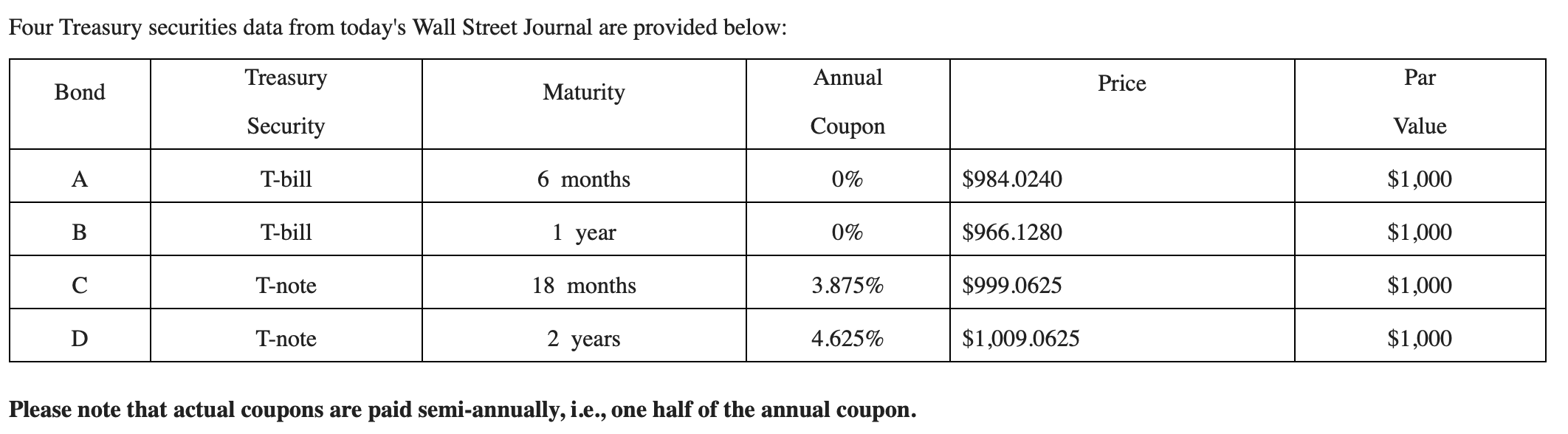

Four Treasury securities data from today's Wall Street Journal are provided below: Treasury Annual Bond Price Par Maturity Security Coupon Value A T-bill 6 months 0% $984.0240 $1,000 B T-bill 1 year 0% $966.1280 $1,000 T-note 18 months 3.875% $999.0625 $1,000 D T-note 2 years 4.625% $1,009.0625 $1,000 Please note that actual coupons are paid semi-annually, i.e., one half of the annual coupon. Four Treasury securities data from today's Wall Street Journal are provided below: Treasury Annual Bond Price Par Maturity Security Coupon Value A T-bill 6 months 0% $984.0240 $1,000 B T-bill 1 year 0% $966.1280 $1,000 T-note 18 months 3.875% $999.0625 $1,000 D T-note 2 years 4.625% $1,009.0625 $1,000 Please note that actual coupons are paid semi-annually, i.e., one half of the annual coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts