Question: 4- Imagine that we are using a Logit model to predict whether a firm will go bankrupt in the next 1 year. We used 3

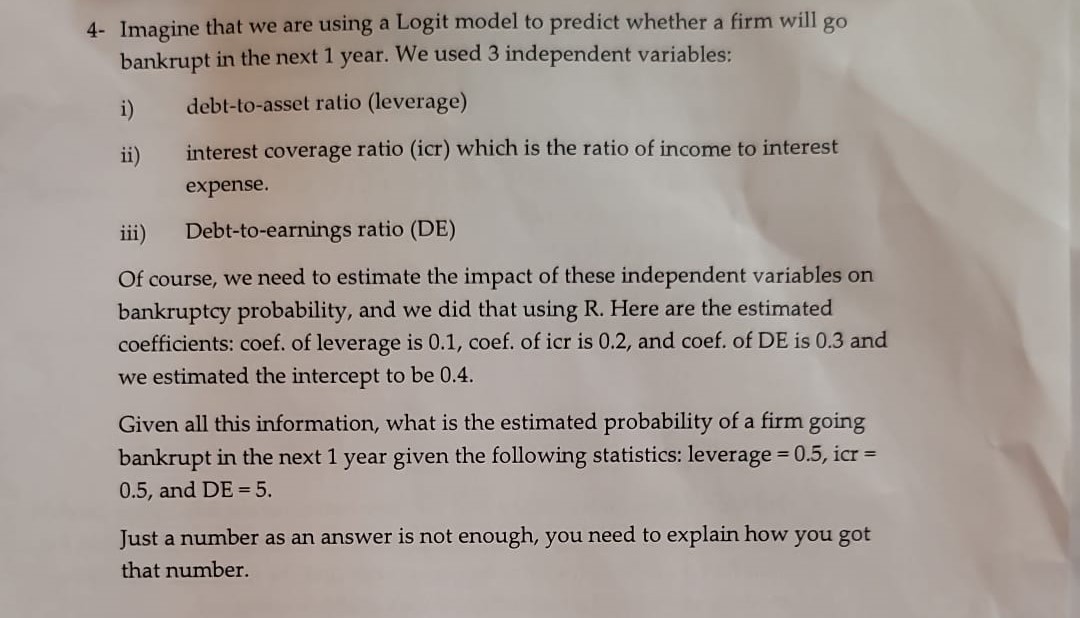

4- Imagine that we are using a Logit model to predict whether a firm will go bankrupt in the next 1 year. We used 3 independent variables: i) debt-to-asset ratio (leverage) ii) interest coverage ratio (icr) which is the ratio of income to interest expense. iii) Debt-to-earnings ratio (DE) Of course, we need to estimate the impact of these independent variables on bankruptcy probability, and we did that using R. Here are the estimated coefficients: coef. of leverage is 0.1 , coef. of icr is 0.2 , and coef. of DE is 0.3 and we estimated the intercept to be 0.4 . Given all this information, what is the estimated probability of a firm going bankrupt in the next 1 year given the following statistics: leverage =0.5, icr = 0.5 , and DE=5 Just a number as an answer is not enough, you need to explain how you got that number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts