Question: 4- Imagine that we are using a Logit model to predict whether a firm will go bankrupt in the next 1 year. We used

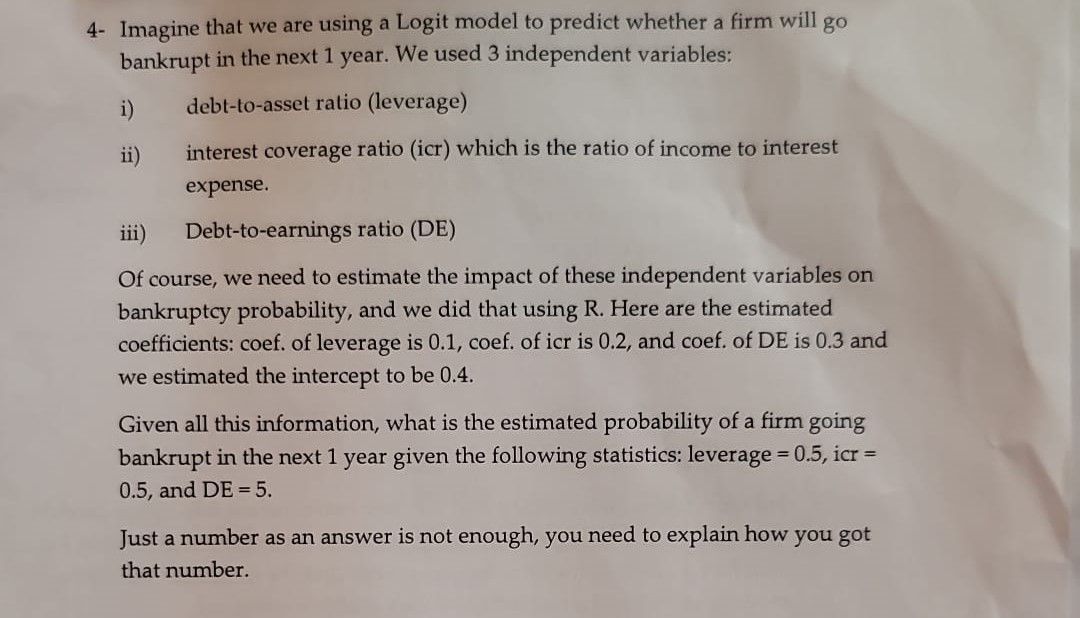

4- Imagine that we are using a Logit model to predict whether a firm will go bankrupt in the next 1 year. We used 3 independent variables: debt-to-asset ratio (leverage) i) ii) interest coverage ratio (icr) which is the ratio of income to interest expense. iii) Debt-to-earnings ratio (DE) Of course, we need to estimate the impact of these independent variables on bankruptcy probability, and we did that using R. Here are the estimated coefficients: coef. of leverage is 0.1, coef. of icr is 0.2, and coef. of DE is 0.3 and we estimated the intercept to be 0.4. Given all this information, what is the estimated probability of a firm going bankrupt in the next 1 year given the following statistics: leverage = 0.5, icr = 0.5, and DE=5. Just a number as an answer is not enough, you need to explain how you got that number.

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

To estimate the probability of a firm going bankrupt in the next 1 year using the given logistic reg... View full answer

Get step-by-step solutions from verified subject matter experts