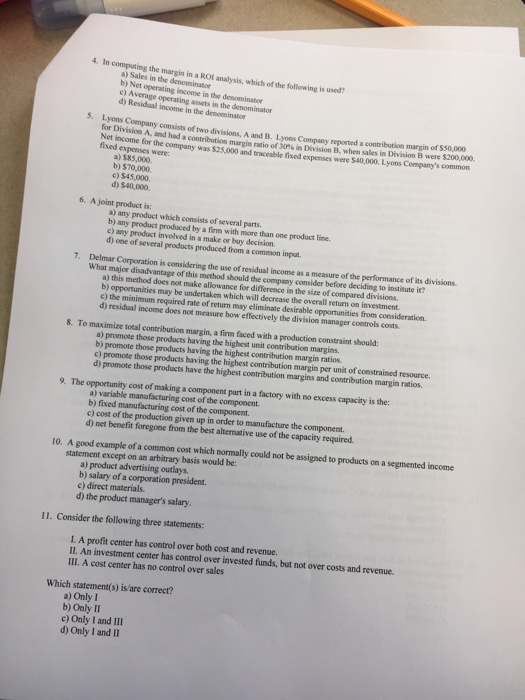

Question: 4. In computing the margin in a ROl analysis, which of a) Sales in the denominator b) Net e) Average operating assets in the denominator

4. In computing the margin in a ROl analysis, which of a) Sales in the denominator b) Net e) Average operating assets in the denominator d) Residual income in the denominator operating income in the denominator 5. Lyons yons C for Division A. and had a contribution margin ratio of 30% Division B, when sales in Division B were Net income for the company was $25,000 and traceable fixed expenses were $40,000. Lyons Company's common fixed expenses were a) $85,000. b) $70,000 c) $45,000 d) $40,000 6. A joint product is: a) any product which consists of several parts. b) any product produced by a firm with more than one product line c) any prodact involved in a make or buy decision d) one of several products produced from a common input 7. Delmar Corporation is considering the use of residual income as a measure of the performance of its divisions. What major disadvantage of this method should the company consider before deciding to institute ire a) this method does not make allowance for difference in the size of compared divisions. b) opportunities may be undertaken which will decrease the overall return on investment. e) the minimum required rate of return may eliminate desirable opportunities from d) residual income does not measure how effectively the division manager controls costs 8. To maximize total contribution margin, a firm faced with a production constraint should: a) promote those products having the highest unit contribution margins. b) promote those products having the highest contribution margin ratios. c) promote those products having the highest contribution margin per unit of constrained d) promote those products have the highest coetribution margins and contribution 9. The opportunity cost of making a component part in a factory with no excess capacity is the: a) variable manufacturing cost of the component. b) fixed manufacturing cost of the component. c) cost of the production given up in order to manufacture the con d) net benefit foregone from the best alternative use of the capacity required 10. A good example of a common cost which normaly could not be assigned to products on a segmented income statement except on an arbitrary basis would be: a) product advertising outlays. b) salary of a corporation president. c) direct materials. d) the product manager's salary I I. Consider the following three statements: I. A profit center has control over both cost and revenue. Il. An investment center has control over invested funds, but not over costs and revenue. III. A cost center has no control over sales Which statement(s) is/are correct? a) Only I b) Only II c) Only 1 and III d) Only I and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts