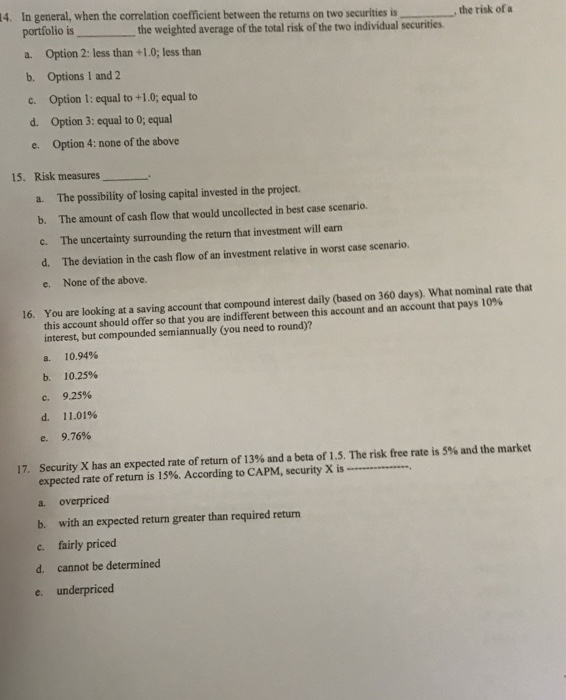

Question: 4. In general, when the correlation coefficient between the returns on two securities is the risk of a portfolio is a. Option 2: less than

4. In general, when the correlation coefficient between the returns on two securities is the risk of a portfolio is a. Option 2: less than +1.0; less than b. Options 1 and 2 c. Option 1: equal to +1.0; equal to d. Option 3: equal to 0; equal e. Option 4: none of the above the weighted average of the total risk of the two individual securities 15. Risk measures The possibility of losing capital invested in the project. The amount of cash flow that would uncollected in best case scenario. The uncertainty surrounding the return that investment will earn The deviation in the cash flow of an investment relative in worst case scenario. None of the above. a. b. c. d. e. 16. You are looking at a saving account that compound interest daily (based on 360 days). What nominal rate that this account should offer so that you are indifferent between this account and an account that pays 10% interest, but compounded semiannually (you need to round)? a. 10.94% b. 10.25% . 9.25% d. 11.01% 9.76% e. Security X has an expected rate of return of 13% and a beta of 1.5. The risk free rate is 5% and the market expected rate of retum is 15%. According to CAPM, security X is-............... a. overpriced b. with an expected return greater than required return c. fairly priced d. cannot be determined 17, e. underpriced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts