Question: I basically konw the answer but I also need explanations on why the answer is correct. If a question requires a numerical answer, provide a

I basically konw the answer but I also need explanations on why the answer is correct. If a question requires a numerical answer, provide a formula that helps to solve it.

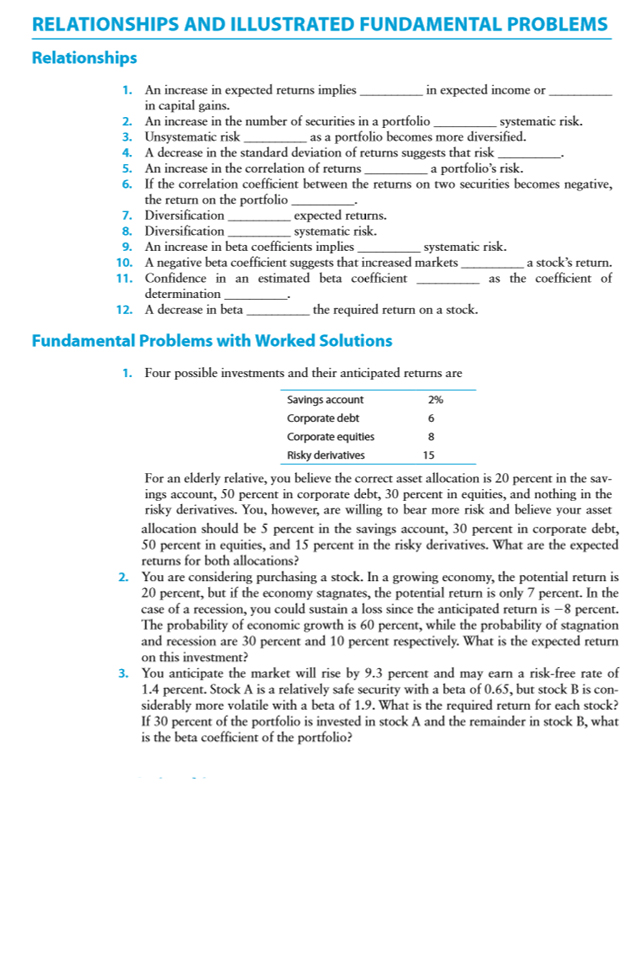

RELATIONSHIPS AND ILLUSTRATED FUNDAMENTAL PROBLEMS Relationships 1. An increase in expected returns implies in expected income or in capital gains. 2. An increase in the number of securities in a portfolio systematic risk. 3. Unsystematic risk as a portfolio becomes more diversified. 4. A decrease in the standard deviation of returns suggests that risk 5. An increase in the correlation of returns a portfolio's risk. 6. If the correlation coefficient between the returns on two securities becomes negative, the return on the portfolio 7. Diversification expected returns. 8. Diversification systematic risk. 9. An increase in beta coefficients implies systematic risk. 10. A negative beta coefficient suggests that increased markets a stock's return. 11. Confidence in an estimated beta coefficient as the coefficient of determination 12. A decrease in beta the required return on a stock. Fundamental Problems with Worked Solutions 1. Four possible investments and their anticipated returns are Savings account Corporate debt 6 Corporate equities 8 Risky derivatives 15 For an elderly relative, you believe the correct asset allocation is 20 percent in the sav- ings account, 50 percent in corporate debt, 30 percent in equities, and nothing in the risky derivatives. You, however, are willing to bear more risk and believe your asset allocation should be 5 percent in the savings account, 30 percent in corporate debt, 50 percent in equities, and 15 percent in the risky derivatives. What are the expected returns for both allocations? 2. You are considering purchasing a stock. In a growing economy, the potential return is 20 percent, but if the economy stagnates, the potential return is only 7 percent. In the case of a recession, you could sustain a loss since the anticipated return is -8 percent. The probability of economic growth is 60 percent, while the probability of stagnation and recession are 30 percent and 10 percent respectively. What is the expected return on this investment? 3. You anticipate the market will rise by 9.3 percent and may earn a risk-free rate of 1.4 percent. Stock A is a relatively safe security with a beta of 0.65, but stock B is con- siderably more volatile with a beta of 1.9. What is the required return for each stock? If 30 percent of the portfolio is invested in stock A and the remainder in stock B, what is the beta coefficient of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts