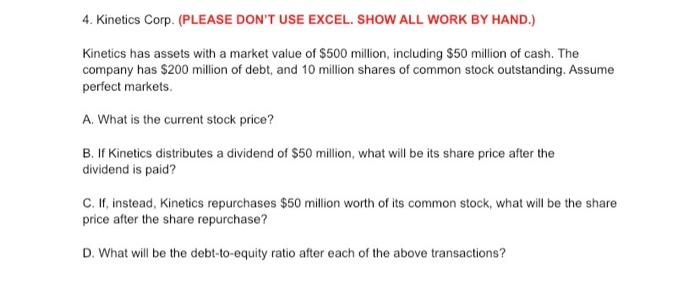

Question: 4. Kinetics Corp. (PLEASE DON'T USE EXCEL. SHOW ALL WORK BY HAND.) Kinetics has assets with a market value of $500 million, including $50 million

4. Kinetics Corp. (PLEASE DON'T USE EXCEL. SHOW ALL WORK BY HAND.) Kinetics has assets with a market value of $500 million, including $50 million of cash. The company has $200 million of debt, and 10 million shares of common stock outstanding. Assume perfect markets. A. What is the current stock price? B. If Kinetics distributes a dividend of $50 million, what will be its share price after the dividend is paid? C. If, instead, Kinetics repurchases $50 million worth of its common stock, what will be the share price after the share repurchase? D. What will be the debt-to-equity ratio after each of the above transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts