Question: 4) Lathe Inc. considers to buy a machine whose cost is 5 000 000 in 2021. The machine may be used for five years and

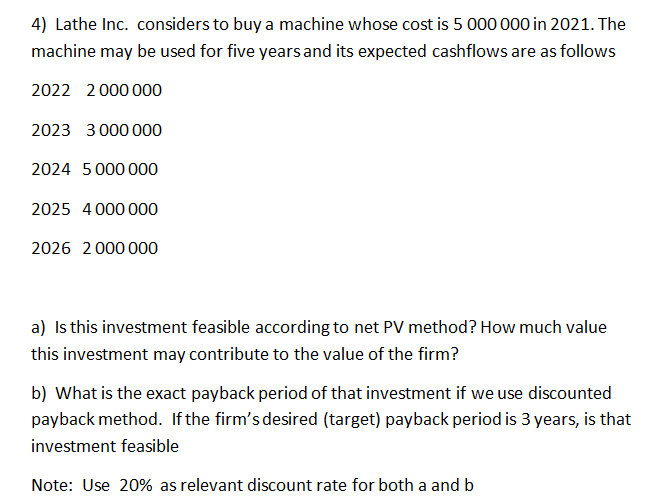

4) Lathe Inc. considers to buy a machine whose cost is 5 000 000 in 2021. The machine may be used for five years and its expected cashflows are as follows 2022 2000 000 2023 3 000 000 2024 5 000 000 2025 4 000 000 2026 2 000 000 a) Is this investment feasible according to net PV method? How much value this investment may contribute to the value of the firm? b) What is the exact payback period of that investment if we use discounted payback method. If the firm's desired (target) payback period is 3 years, is that investment feasible Note: Use 20% as relevant discount rate for both a and b

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock